Bison vs Bitpanda Compared for 2025: Which Broker is better for Crypto and Stocks?

Bison and Bitpanda are European multi-asset brokers that offer simple trading of cryptocurrencies, stocks, and ETFs.

While Bitpanda is long-established and already has a large customer base, the German broker Bison is fairly new, yet rising in popularity day by day.

In this comparison, we will take a look at the pros and cons of Bitpanda vs Bison, to help you determine whether Bison or Bitpanda are better brokers for your use case.

Verification Procedure

As both Bitpanda and Bison follow the same European guidelines on AML procedures, the registration process is nearly identical for both these brokers.

Namely, users of Bitpanda and Bison are required to enter personal information during registration and verify their identity via an online KYC procedure that involves a quick video call or similar.

However, because some users report that the waiting time for verification on Bitpanda is slightly shorter than on Bison, Bitpanda compares just slightly better in terms of registration speed.

Bison vs Bitpanda: Which Assets Are Tradable?

Bison and Bitpanda are both multi-asset brokers that aren't limited to cryptocurrencies but also allow users to trade stocks, ETFs, and more.

On the surface, the trade offering of Bitpanda is more convincing, because Bitpanda supports trading of a few more assets than Bison.

| Bison | Bitpanda | |

|---|---|---|

| Cryptocurrencies | Yes | Yes |

| ETFs | Yes | Yes |

| Stocks | Yes | Yes |

| CFDs | No | Yes |

| Crypto Indices | No | Yes |

| Derivates | No | Yes |

| Precious Metals | No | Yes |

It's worth noting that stocks on Bitpanda are actually just derivatives contracts that allow you to invest any amount of money into stocks, while on Bison, users buy real stocks.

When it comes to the number of tradable assets, there also are some differences between Bison and Bitpanda:

| Bison | Bitpanda | |

|---|---|---|

| Total Tradable Cryptocurrencies | 17+ | 200+ |

| Total Tradable Stocks | 2500+ | 2185+ |

| Total Tradable ETFs | 850+ | 185+ |

For investors with a focus on cryptocurrencies, Bitpanda has a larger and hence better coin offering of 200+ coins compared to Bison with just 17 cryptocurrencies.

In terms of stocks, Bison with a total of 2500+ tradable stocks has more to offer than Bitpanda with 2185+ stocks.

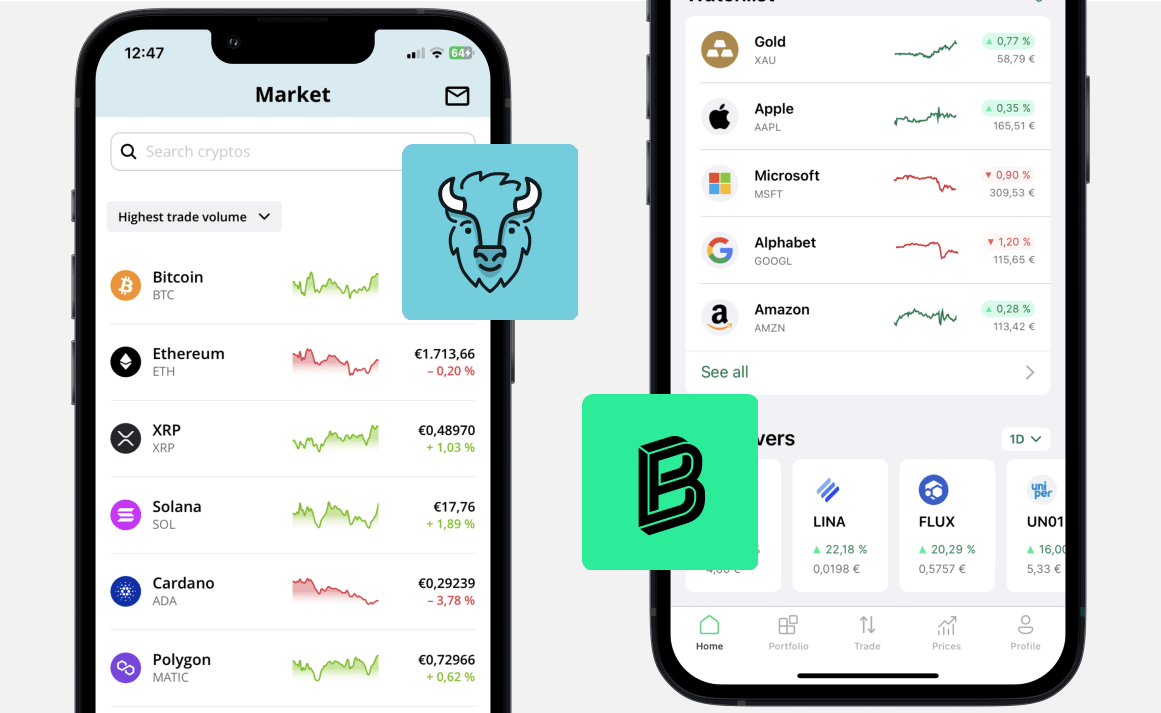

Trading Platform: Bison vs Bitpanda

Bitpanda and Bison both focus on making investing accessible and easy for beginners, which is reflected in their trading interfaces.

Both Bitpanda and Bison have easy trading interfaces for all assets on both desktop and mobile devices, making the two compared brokers equally beginner friendly.

Hence, for stock and ETF investors, the comparison of trading platforms of Bitpanda vs Bison will not be a deciding factor.

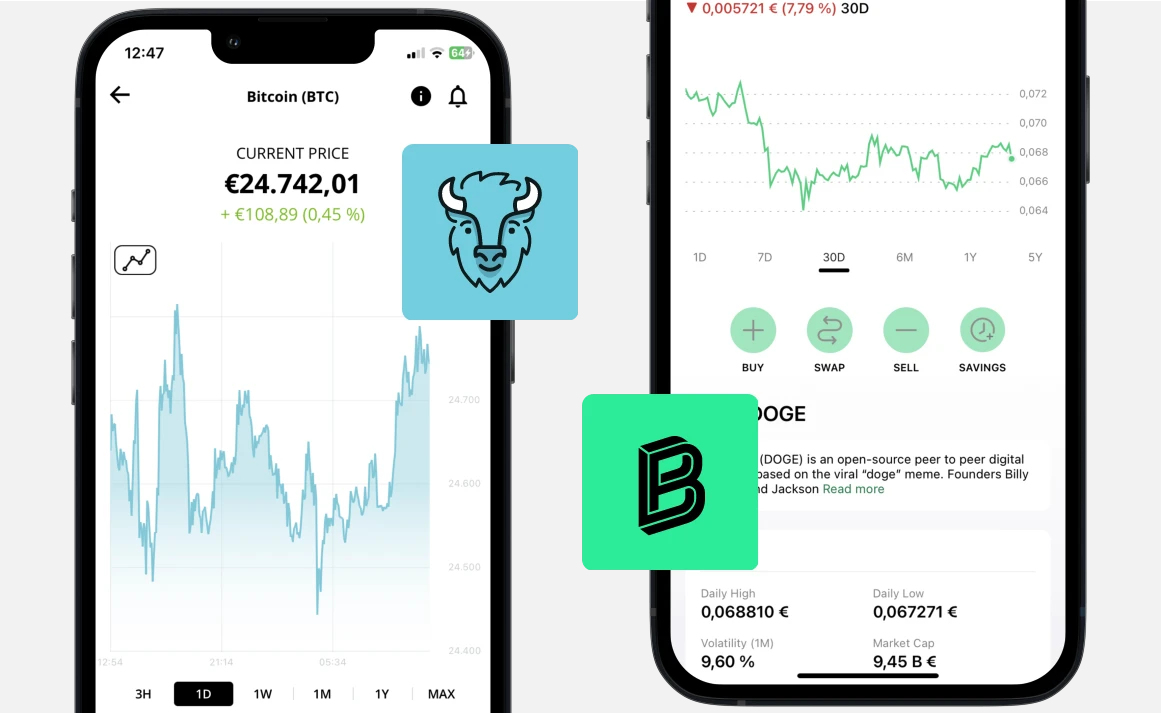

Crypto Trading

When it comes to trading cryptocurrencies, Bitpanda and Bison show differences in their platform structure as a whole:

With Bitpanda Pro, users of Bitpanda can directly exchange cryptocurrencies with one another, which is much more cost-efficient than trading on Bison as the comparison of advanced fees shows.

This means that advanced crypto traders who value trading features and cost-efficiency will definitely be better off with Bitpanda Pro instead of Bison.

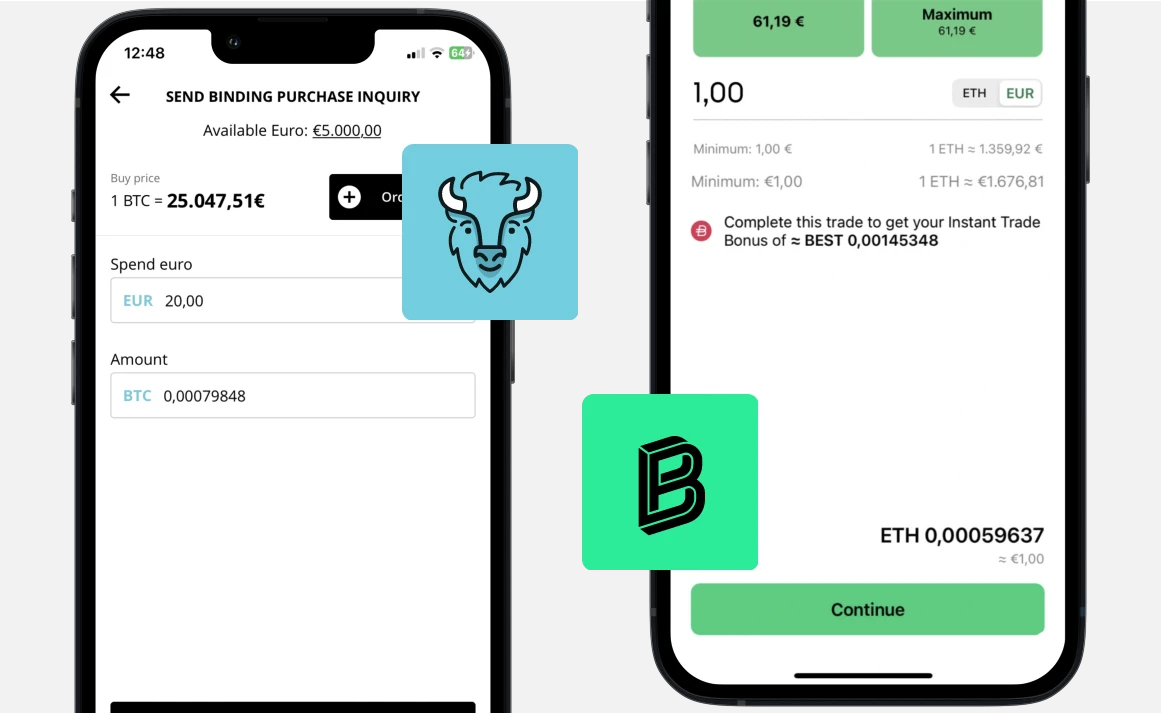

DCA Savings Plan

A common benefit of Bison and Bitpanda is that both brokers offer DCA savings plan for crypto, stocks, and ETFs. Meaning: users can automatically invest in all kinds of assets in arbitrary intervals.

On

Bison , you can set up an automatic investing plan starting from 0.01€. The chosen savings plan amount will be periodically subtracted from your Bison account balance and automatically invested into your specified asset.

On

Bitpanda , the minimum investment amount for a savings plan is 25€, and unlike Bison, the money for automatic investing is taken directly from your credit card or bank account via a standing order.

We find that the lower minimum investment amount makes it easier for beginners to start a savings plan on Bison than on Bitpanda. This gives Bison a small advantage in this comparison versus Bitpanda.

Fees: Bison vs Bitpanda

Bison and Bitpanda have different trading fees for different assets but generally compare pretty similar in terms of fees.

| Bison | Bitpanda | |

|---|---|---|

| Default Crypto Trading Fee | 1.25% | 1.49% |

| Advanced Crypto Trading Fee | 1.25% | 1.49% |

| Average Crypto Trading Fee | 1.25% | 1.49% |

| Stocks Trading Fee | 1.99€ | ~0.7% |

| ETFs Trading Fee | 1.99€ | ~0.7% |

| Inactivity Fees | 0% | 0% |

To find out whether Bitpanda or Bison is better in terms of fees for you, let's take a look at the fees for specific assets:

Fees for Stocks & ETFs

For stocks and ETFs, the fee on Bitpanda is spread of ~0.7% that is relative to your trading volume, while Bison charges a fixed order fee of 1.99€.

For investors who regularly invest large, 3+ digit amounts per order, fees on

Bison are better than Bitpanda's spread

For those who trade just small amounts into stocks,

Bitpanda's relative fee is better than the fixed fee on Bison

Fees for Cryptocurrencies

When trading cryptocurrencies in the easy mode, Bison has a lower fee of 1.25% compared to Bitpanda with a fee of 1.49%. This makes Bison generally better for crypto beginners than Bitpanda in terms of fees.

When trading on Bitpanda's dedicated crypto exchange Bitpanda Pro , crypto investors benefit from even lower fees of 1.49% that Bison - as a broker - cannot hold up with. Hence, for advanced crypto investors, Bitpanda Pro is significantly better than Bison, and at the same time offers more cryptocurrencies for trading.

Who has better Fees: Bison Or Bitpanda?

We have rated fees on Bison with 88/100, compared to Bitpanda with 83/100. Note that Bison and Bitpanda have different fee structures that are more or less beneficial depending on your traded asset and volume.

Regulations and Licenses: Bison vs Bitpanda

Bison and Bitpanda are located in Europe, and both have licenses to legally operate their brokerage and crypto exchange operations in the EEA.

Furthermore, Bitpanda and

Bison are both regulated by the German BaFin, which is rarely seen in the world of crypto and a shared advantage of both these brokers.

In fact, regulatory safety is the major strength of both compared brokers. While this is great for investors focused on security, higher regulatory bureaucracy results in Bitpanda and Bison having higher crypto trading fees compared to less-regulated exchanges such as Bitvavo.

Bison or Bitpanda: Who Wins the Comparison?

Bison and Bitpanda are both great European multi-asset brokers for investing in crypto and stocks.

In the comparison of Bison vs Bitpanda, Bison performs better for beginning crypto investors and mid- to high-volume stock and ETF investors.

The Bitpanda broker on the other hand performs better than Bison when it comes to advanced crypto trading and investing small amounts into stocks and ETFs.

Below you can find a summary of ratings given for Bitpanda and Bison:

| Bison | Bitpanda | |

|---|---|---|

| Account Opening | 90% | 90% |

| Available Coins | 83% | 96% |

| Trading Fees | 88% | 83% |

| Beginner Friendliness | 95% | 92% |

| Features | 80% | 94% |

| Final Rating | 87% | 91% |

Ultimately, Bitpanda with a rating of 91/100 is the winner of this comparison against Bison with a rating of 87/100.