Our Bitpanda Review 2025

When looking for modern European trading platforms for stocks, crypto, and commodities, the name Bitpanda comes up frequently, as the Bitpanda broker is one of the most popular investing platforms for both beginners and advanced traders.

We have tested Bitpanda to highlight its pros and cons, helping you understand how Bitpanda works and to decide whether this exchange is suitable for your needs.

What is Bitpanda?

Bitpanda is an Austrian trading platform that focuses on offering new investors an easy start to trading cryptocurrencies, stocks, ETFs, ETCs, and metals while maintaining highly competitive features and decent trading fees.

Since its founding in 2014, Bitpanda has grown to one of the most popular European investing platforms with around 700 employees and 4 million users trading assets ranging from stocks to a wide selection of 200+ unique cryptocurrencies.

With Bitpanda offering both an easy-to-use investing interface with no room for errors, as well as advanced trading functionality with Bitpanda Pro, the Bitpanda investing platform allows investors of any experience level to invest on either their fully-featured mobile app or website.

Bipanda Registration process

To start investing on Bitpanda, users are required to register for an account on Bitpanda's registration page , which involves entering an email, setting a password, and sharing some basic personal information.

Currently, Bitpanda only allows users from roughly 36 accepted countries to register on their trading platform, which are listed below:

| Bitpanda Accepted Countries |

|---|

| 🇦🇪 United Arab Emirates, 🇦🇱 Albania, 🇦🇹 Austria, 🇧🇪 Belgium, 🇧🇬 Bulgaria, 🇨🇭 Switzerland, 🇨🇾 Cyprus, 🇨🇿 Czech Republic, 🇩🇪 Germany, 🇩🇰 Denmark, 🇪🇪 Estonia, 🇪🇸 Spain, 🇫🇮 Finland, 🇫🇷 France, 🇬🇧 United Kingdom, 🇬🇷 Greece, 🇭🇷 Croatia, 🇭🇺 Hungary, 🇮🇪 Ireland, 🇮🇸 Iceland, 🇮🇹 Italy, 🇱🇮 Liechtenstein, 🇱🇹 Lithuania, 🇱🇺 Luxembourg, 🇱🇻 Latvia, 🇲🇹 Malta, 🇳🇱 Netherlands, 🇳🇴 Norway, 🇵🇱 Poland, 🇵🇹 Portugal |

Investors whose country of residence is not included in the Bitpanda accepted countries list unfortunately need to look out for a different exchange to trade crypto and other assets on. We have ranked many popular cryptocurrency exchanges that are available globally on this page.

Bitpanda KYC

To stay compliant with regulations and offer a legitimate investing platform, users on Bitpanda have to verify their identity to start trading any of the available assets on Bitpanda.

The KYC verification on Bitpanda is straightforward and mostly consists of uploading an image of your ID or passport as well as either recording your face using a mobile app, or entering a short video call with a third-party identification company.

Therefore, you only need either an ID or passport depending on your country as well as a mobile phone to complete KYC verification and start investing on Bitpanda.

We believe the quick registration and verification process of Bitpanda fits into their goal of making investing easy and accessible, which marks an advantage of Bitpanda, especially for beginning investors.

As a result, Bitpanda has received a rating of 90/100 for their speed and ease of registration in our Bitpanda test review.

Is Bitpanda legitimate?

The Bitpanda trading platform has various VASP registration for AML purposes as well as MiFID II, E-Money, and PSD II licenses that ensure Bitpanda is a transparent and regulated trading platform that securely manages user assets.

Furthermore, the Bitpanda crypto exchange is fully licensed by the German BaFin, making Bitpanda a legitimate European cryptocurrency exchange.

Bitpanda has been successfully offering its platform since 2014 without any scandals, which confirms Bitpanda's legitimacy.

The wide set of regulations makes Bitpanda a legitimate and highly trustworthy crypto exchange, marking a major argument for choosing Bitpanda as the go-to investing platform.

Bitpanda Security

Bitpanda does not only convince when it comes to regulations but also in terms of its security features that ensure the safety of user funds.

Due to Bitpanda's wide range of regulations and licenses, the investing platform is actively being monitored and audited by authorities, making Bitpanda highly transparent.

This ensures that user assets are stored securely on Bitpanda, without being lent out or speculated, always guaranteeing enough liquidity for you to withdraw your assets on Bitpanda.

Bitpanda maintains a trust agreement, which legally separates the assets held on behalf of its clients from Bitpanda's own assets. As a result, in case of bankruptcy, these assets cannot be used to settle Bitpanda's debts or liabilities, which makes us believe that Bitpanda is highly trustworthy.

In addition to that, Bitpanda also has many security features in place that make investing on Bitpanda secure, such as:

High data protection due to Bitpanda being located in Europe

Storing of user assets in a highly secure environment

Internal Security scans for both software and employees

Two-Factor Authentication and active account monitoring

Bitpanda's security is reflected in the investing platform receiving an ISO 27001 certification for high standards in information security management, which has led us to believe in our Bitpanda test review that this investing platform is highly secure and trustworthy.

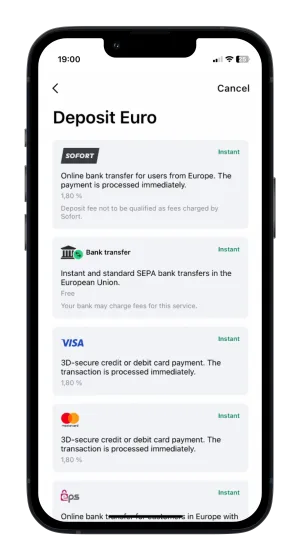

Bitpanda Payment Methods

After you have created a Bitpanda account, you need to deposit funds to your Bitpanda account to start investing in stocks, cryptocurrencies, ETFs, or commodities.

Your first deposit on Bitpanda after opening your account needs to be at least €25. After that, the minimum deposit on Bitpanda is just €1.

The Bitpanda broker offers different deposit methods depending on your region and currency, but most importantly: SEPA bank transfers, Visa, Mastercard, Skrill, or other cryptocurrencies that you already own.

| Accepted Currencies | Daily Limit (€) | |

|---|---|---|

| SEPA Bank transfer | EUR, GBP, CHF | 500000 |

| Visa, Mastercard | EUR, USD, CHF, GBP, PLN, DKK, SEK, HUF, CZK | 2500 |

| Skrill | EUR, USD, CHF, GBP | 10000 |

| Sofort | EUR, CHF | 10000 |

| NETELLER | EUR, CHF, GBP | 10000 |

| Giropay, EPS | EUR | 10000 |

| RAPID | GBP | 10000 |

| EFT/Havale | TRY | 10000 |

Note that at the time of writing users on Bitpanda can only use bank transfers using Euro, the Swiss Franc, or the British Pound Sterling. Hence, users from other regions will need to use third-party payment providers to top up their investment balance on Bitpanda.

Bitpanda supports SEPA Instant deposits, meaning with most modern online banking providers, users will be able to deposit via bank transfer in nearly instant time.

Like most other cryptocurrency exchanges and brokers, Bitpanda, unfortunately does not offer deposits with PayPal.

When depositing small amounts of crypto from your own wallet, Bitpanda usually charges a small service cost of a few US Dollars worth of your coins, which marks a minor disadvantage in our Bitpanda review.

Something that makes Bitpanda highly unique is the fact that this investing platform offers users to trade all possible assets ranging from stocks to cryptocurrencies and commodities - at the same time not sacrificing quality and user experience.

We have tested trading on Bitpanda and will share our personal experiences and details related to trading all sorts of assets on Bitpanda.

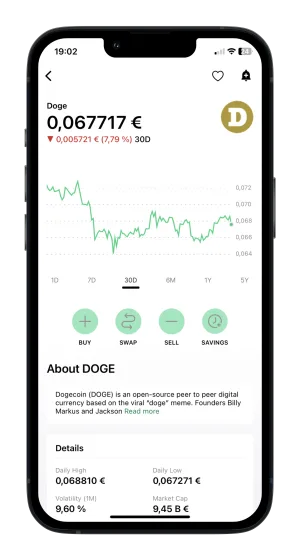

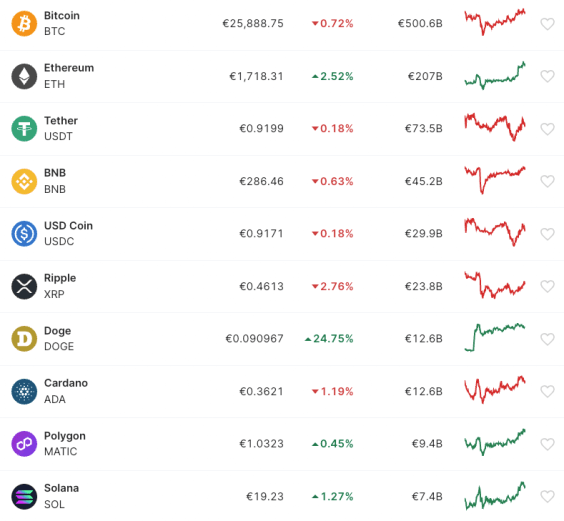

Cryptocurrencies on Bitpanda

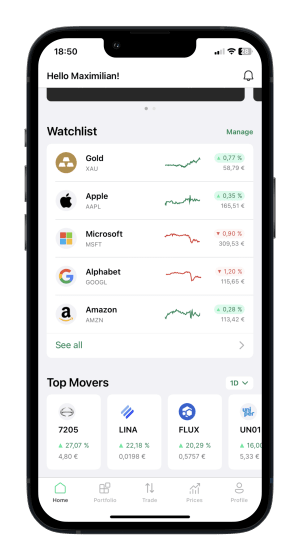

Bitpanda is perhaps mostly known for offering one of the biggest selections of roughly 200+ tradable cryptocurrencies from all European crypto exchanges.

When buying crypto on Bitpanda, the coins end up being purchased on the spot market, meaning that the vast majority of purchased cryptocurrencies on Bitpanda can be withdrawn to your personal crypto wallet if you wish so.

Given the big selection of available coins, even keen altcoin investors won't miss many of their favorite cryptocurrencies when trading on Bitpanda, making Bitpanda a great crypto exchange for buying both Bitcoin and altcoins.

In terms of quality and quantity of the available coins, Bitpanda was rated 96/100 as part of this Bitpanda review.

Bitpanda vs. Bitpanda Pro

Something you should know before getting started with crypto on Bitpanda is that there are two different ways of trading Bitcoin and other cryptocurrencies on Bitpanda.

Users can either use the simple investing interface, where Bitpanda serves as a broker or alternatively trade on Bitpanda Pro, the platform's advanced crypto spot exchange.

| Bitpanda (default) | Bitpanda Pro | |

|---|---|---|

| Liquidity Provider | Bitpanda | Users of Bitpanda Pro |

| Tradable Assets | Cryptocurrencies, Stocks, ETFs, ETCs, Metals | Cryptocurrencies |

| Tradable Cryptocurrencies | 200+ | Only a fraction of those 200 |

| Crypto Trading Fees | 1.49% | 0-0.25% |

| Orders | Market | Market, Limit, Stop-Limit |

| Trading Charts | ❌ | ✅ |

| Available 24/7 | ✅ | ✅ |

The key differences: While Bitpanda offers easy trading with moderate to high surcharges, Bitpanda Pro is a bit more advanced in usage but in return has lowers costs.

Trading Crypto on Bitpanda

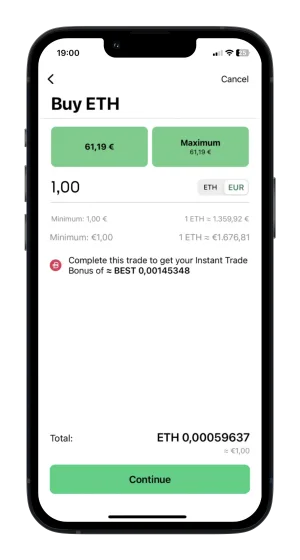

When trading crypto on Bitpanda's simple interface, Bitpanda purchases and sells the cryptocurrencies on your behalf on the spot market, allowing Bitpanda to offer you a price guarantee for 60 seconds and an overall easy crypto trading experience without room for errors.

The default crypto investing mode may be beneficial to beginners who do not want to risk making any mistakes during the trading process, but it comes with the disadvantage of surcharges and no granular order options.

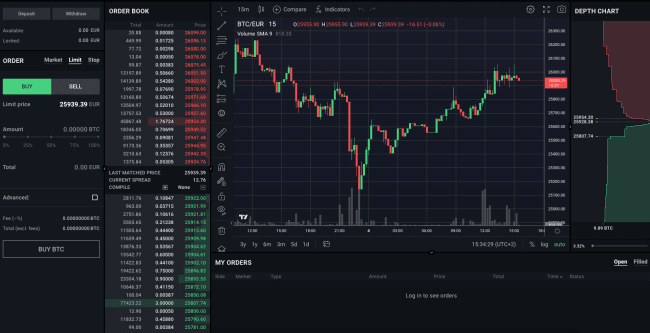

Trading Crypto on Bitpanda Pro

On the other hand, buying or selling cryptocurrencies on Bitpanda Pro involves directly trading with other users of Bitpanda Pro instead of relying on Bitpanda to act as your broker.

This direct trading with other users on Bitpanda Pro results in paying no spread and more trading options than Bitpanda's default investing interface, and is hence highly recommended if your crypto trading pairs are available.

Even though Bitpanda Pro may seem intimidating for beginners at first, after getting familiar with Bitpanda Pro, you can execute the same market orders just as with the simple Bitpance interface with just a few clicks, and at the same time benefit from higher cost-efficiency.

While Bitpanda's default mode is a valid option for beginners and investors who value convenience, we recommend learning the advanced trading interface of Bitpanda Pro to maximize capital efficiency when investing.

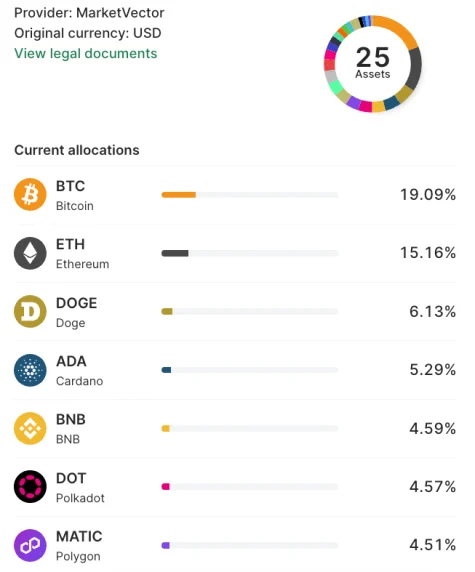

Bitpanda Crypto Indices

In addition to trading specific cryptocurrencies, investors on Bitpanda can also buy and sell many crypto indices, which are managed crypto portfolios with a fixed allocation that gets automatically rebalanced in monthly intervals.

Bitpanda's crypto indices are especially useful for new crypto investors who would like to gain diversified exposure in the crypto markets without having to learn the ins and outs of all cryptocurrencies to choose which ones to invest in.

A major advantage of Bitpanda crypto indices we noticed in our Bitpanda review is the fact that these portfolios have automatic rebalancing, meaning you personally do not have to buy or sell any cryptocurrencies which would not only be a recurring effort.

Convenience comes at a cost: trading crypto indices on Bitpanda has a surcharge of ~0.5% compared to simply buying the cryptocurrencies manually, as well as another 1.99% monthly cost applied to the rebalanced amount after every single rebalancing. Also, the rebalancing of Bitpanda Crypto Indices can cause a taxable event in your legislation.

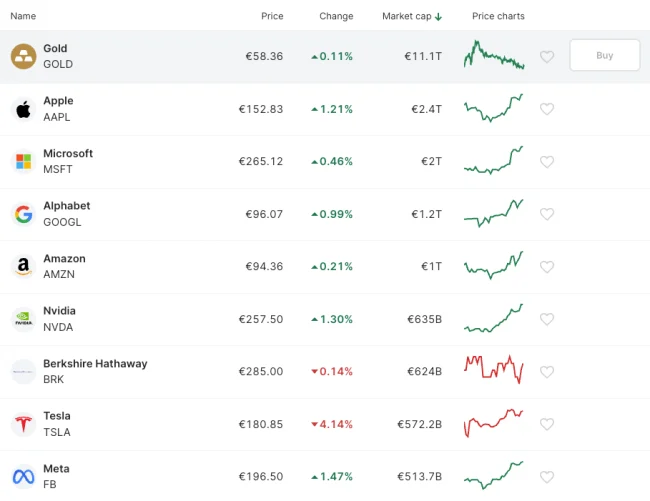

Stocks and ETFs on Bitpanda

Besides cryptocurrencies, users on Bitpanda can invest in popular stocks, ETFs, and commodities, starting from as small amounts as €1.

To make investing accessible to anyone, Bitpanda does not force users to buy entire shares of stocks or ETFs. Instead, when trading stocks or ETFs on Bitpanda, users buy so-called derivative contracts representing a 1:1 value of the respective stock or ETF.

In essence, this means that Bitpanda buys the underlying stocks, ETFs, and allows you to purchase fractions of those assets without physically owning them, marking yet another unique perk in this Bitpanda review.

I personally believe that while Bitpanda's approach to this so-called fractional trading will be appreciated by the majority of retail investors, it adds another layer of trust in Bitpada's third-party custodian bank of those assets that can justifiably be disliked.

Precious Metals on Bitpanda

Users on Bitpanda can buy and sell physical precious metals like gold, silver, palladium, and platinum which are all physically stored in a vault in Switzerland.

While owning physical metals may have some potentially beneficial implications regarding security and taxes, from my experiences with Bitpanda, the storage costs for these metals are higher than common annual costs for respective ETCs of those metals - which is not a surprise, but worth noting.

Unfortunately, in my review of Bitpanda, I did not find any tradable ETCs for the offered precious metals, which limits the options of investors and marks a disadvantage of Bitpanda for more advanced investors.

Still, the running costs for precious metals on Bitpanda seem to be reasonably cheaper than storing those precious metals on your own, which makes investing in precious metals count as an overall well-executed feature in this Bitpanda test review 2025.

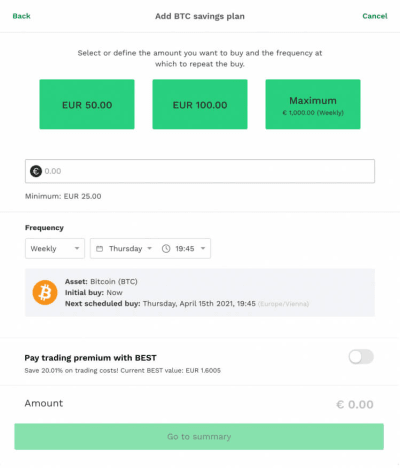

Bitpanda DCA Savings Plan reviewed

On Bitpanda, investors are not limited to manually investing in crypto and stocks, as Bitpanda offers an automatic savings plan that can be executed via recurring SEPA bank transfers or credit card payments.

When setting up a savings plan on Bitpanda, users select an interval and an amount of money in which any cryptocurrencies or stocks of their choice are being bought automatically for them, without additional surcharges.

Such a savings plan as offered on the Bitpanda broker can help investors stay consistent with regularly saving money, take away the fear of an instant crash after a one-time investment, or even execute a DCA investing strategy with custom options.

Such saving plans are a widely appreciated feature on crypto and stock brokers, and the fact that you can execute one on Bitpanda with both bank transfers and automatic credit card payments makes us see this feature as another advantage in our Bitpanda review.

When buying crypto via an automatic DCA on Bitpanda, you miss out on the higher cost-efficiency of the Bitpanda Pro exchange.

Bitpanda BEST Token reviewed

The Bitpanda investing platform has its own cryptocurrency token called BEST, which acts as a utility token for the Bitpanda ecosystem that gets burned periodically, meaning the BEST token gets more scarce as time goes on.

In practice, users can buy and hold the BEST token directly on Bitpanda, granting them a VIP status that comes with various benefits on the Bitpanda trading platform, such as:

Rewards in the form of BEST tokens for instant trading crypto & stocks

Weekly BEST rewards for holding BEST on Bitpanda

Exclusive partner rewards, premium support & more

Rights to vote on important updates on Bitpanda

Generally speaking, the more BEST you have on Bitpanda, the higher your VIP level, and hence the better the associated benefits are:

| VIP Level | BEST tokens held on Bitpanda | Weekly Rewards (% of BEST held) | Instant Trade Bonus relatively to your trading volume |

|---|---|---|---|

| 0 | > 0 | - | - |

| 1 | 10 | 0.1% + Bonus for trading volume | 0.05% for crypto, 0.005% for stocks |

| 2 | 1000 | 0.125% + Bonus for trading volume | 0.1% for crypto, 0.01% for stocks |

| 3 | 5000 | 0.15% + Bonus for trading volume | 0.15% for crypto, 0.015% for stocks |

| 4 | 10000 | 0.175% + Bonus for trading volume | 0.2% for crypto, 0.02% for stocks |

| 5 | 50000 | 0.2% + Bonus for trading volume | 0.25% for crypto, 0.025% for stocks |

Depending on the current price of Bitpanda's BEST token and your personal trading volume, owning some BEST could be considered more or less worth it.

As you can see so far, Bitpanda is full of useful features that may require some time to fully see through, leading us to rate Bitpanda with 94/100 points in terms of feature richness in our review of the Bitpanda broker.

Bitpanda Rating

Summing up all objective facts as well as personal experiences we made with Bitpanda throughout our review, we have created a final Bitpanda rating that sums up the pros and cons of the Austrian broker.

For our final Bitpanda rating, major aspects such as registration speed, fees, available coins, and the overall simplicity of the broker were considered:

| Bitpanda Rating | |

|---|---|

| Registration Speed | 90% |

| Simplicity | 92% |

| Coins | 96% |

| Fees | 83% |

| Features | 94% |

| Final Rating | 91% |

As a final result, we have given Bitpanda a rating of 91/100 for all majorly covered aspects covered in detail throughout our review.

Our Opinion: Is Bitpanda Good?

Bitpanda is a highly reputable and modern investing platform that allows users to quickly access all sorts of investing assets, ranging from cryptocurrencies to stocks, ETFs, metals, and crypto indices.

Throughout our Bitpanda review, it has become apparent that investing in crypto, stocks, and co. on Bitpanda is not only super easy but also feature-rich and under some conditions highly cost-efficient if you know your way around the details mentioned in this test review.

This makes Bitpanda seem especially fitting for advanced crypto traders who will make use of Bitpanda Pro's highly competitive cost-efficiency, as well as beginners who value an easy start into investing with the option to pick up more assets than just crypto along the way.

Given Bitpanda's overall high rating of 91/100, we believe that most users won't be disappointed when choosing Bitpanda, making Bitpanda a recommended broker and cryptocurrency exchange in 2025.