The decision to get started with crypto is a bold step, to say the least, but there's probably no other emerging asset that deserves your attention as much as cryptocurrencies in 2025.

While investing in crypto comes with great volatility and self-responsibility, there are a few essential steps and must-knows on our crypto beginner checklist that can help you get started investing in crypto and avoid major mistakes that many crypto beginners make.

In this crypto beginner guide, we will cover fundamental topics and valuable tools and resources that can assist you in beginning with cryptocurrencies.

1. Understand the Types of Crypto

Although all cryptocurrencies are based on blockchain technology, there are fundamental differences between Bitcoin and other cryptocurrencies that are important to understand.

While Bitcoin is scarce, digital money, most other so-called altcoins are more like FinTech products with countless different use cases that do not always solve real-world problems.

This is why buying Bitcoin is considered relatively safe compared to altcoins, because Bitcoin is a mature project with many eyes on it, while other cryptocurrencies frequently see both huge gains and total collapses.

Bitcoin plays an incredibly crucial role in cryptocurrencies, which is why anyone starting with crypto should begin by getting to know Bitcoin in detail.

In addition to Bitcoin, there is a constantly growing range of different cryptocurrencies that fundamentally vary in their use cases, which we would classify into 5 most important types to get started:

🛣 Platform Coins are the native cryptocurrencies of their respective blockchain. These cryptocurrencies can be compared to stocks of entire blockchains. By buying platform coins, you invest in the entire ecosystem of that specific network.

Examples: Ethereum, Polkadot, Solana💳 Payment Coins are cryptocurrencies with one primary goal: providing decentralized money for the people. By investing in these coins, you bet on them gaining more adoption as a form of payment in the future.

Examples: Bitcoin, Litecoin, Dash, Bitcoin Cash🔑 Utility Tokens are very specific crypto tokens that provide access or benefits for single applications, such as exchanges or marketplaces. They can be compared to stocks of specific financial applications.

Examples: Uniswap Token, Chainlink, BNB🐕 Meme Coins are highly speculative coins created as a joke, whose value is purely based on social media hype. Buying these coins is much more like gambling, as one does not buy any underlying value.

Examples: Dogecoin, Shiba Inu, SafeMoon🖼 NFTs are one-of-a-kind crypto tokens that represent ownership of a unique specimen, ranging anywhere from digital pieces of art to VIP cards or even real estate.

Examples: Bored Ape Yacht Club

Getting to understand all these cryptocurrencies takes a lot of time and effort, but when just getting started with crypto as a beginner, you should know that it's not necessary to buy all sorts of cryptocurrencies to participate in the crypto market:

By investing in the big platform coins like Bitcoin or Ethereum you indirectly also invest in all applications built on top of these respective networks.

The reason for this is that these platform coins are required in order to use any other applications on the respective blockchains.

Therefore, investing in different platform coins like Ethereum covers the entire crypto market with a relatively diversified risk, making it a popular option for crypto beginners.

2. Choose a Crypto Exchange

Whether you'd like to start investing in Bitcoin or other cryptocurrencies, there barely leads a way around a good crypto exchange that simplifies this process for you.

You can easily buy and sell all types of cryptocurrencies online on suiting cryptocurrency exchanges, which are platforms that allow you to trade in your traditional money for crypto in a fast and secure manner.

Because some crypto exchanges are too complicated and create a bigger room for errors for crypto beginners, we maintain the following list of relatively easy-to-use crypto exchanges that are suitable for crypto beginners:

Before choosing a crypto exchange for the first time, there are some important things to consider, which our listing of exchanges also takes into consideration:

Picking a suitable exchange as a crypto beginner

Is the exchange available in your country?

Is the exchange regulated? If yes, where?

Can you buy actual, withdrawable crypto or only futures?

Is the minimum deposit low enough?

Is trading on the exchange easily done, or does it require experience?

Picking an exchange when getting started with cryptocurrencies is an important aspect that shouldn't be rushed. Therefore feel free to take a look at our test and ranking of the best crypto exchanges in detail on the following page:

3. Decide Which Crypto to Buy

Even though it requires a lot of knowledge and experience to evaluate which crypto assets truly provide value and are worth investing in, and which ones are pure money grabs, one does not have to be an expert to cautiously get started investing in cryptocurrencies.

For a crypto beginner who'd like to start investing in crypto in 2025 without spending countless hours studying cryptocurrencies, there are a few known popular options worth mentioning in this crypto beginner guide that beginners frequently choose when starting to buy cryptocurrencies:

| Option | 💭 Opinion | ✅ Pros | ❌ Cons |

|---|---|---|---|

| Start out with Bitcoin and slowly get to know other crypto assets with time | 👍 | Low effort, Bitcoin is considered relatively stable | Undiversified risk |

| Start out with a diversified crypto index until you gain more experience and knowledge | 👍 | Low effort, diversified risk | No Spot ETFs on the market yet |

| Learn and research crypto projects until you can decide why and which crypto to buy | 👍 | Responsible investments | Very time-consuming |

| Blindly pick some popular cryptocurrencies and hope for the best | 😐 | Low effort, diversified risk | Unfounded decision |

| Rely on influencers and social media regarding which crypto to buy | 👎 | Low effort | Irresponsible investing, Risk of scams |

Starting with Bitcoin

Because until this day one can observe that Bitcoin leads the crypto markets, sticking to Bitcoin, the biggest and most stable cryptocurrency, is a valid option for crypto beginners to quickly gain exposure to the crypto markets while keeping their risk relatively low compared to other, more risky altcoins.

Bitcoin's relative performance often is a mirror of the entire crypto market, while Bitcoin does not experience as high up- and downside movements as smaller, riskier cryptocurrencies.

This makes Bitcoin seem like the relatively most stable way for crypto beginners to start investing in cryptocurrencies from all options mentioned in our practical crypto beginner guide.

While crypto beginners investing in Bitcoin may seem a bit boring, one should not forget that the entire crypto space only exists because of Bitcoin, and while crypto is still an experimental market, Bitcoin is one of the very few finished products that provide actual value for people.

Diversified Crypto Indices

In the traditional financial world, beginners are often recommended to start investing in ETFs, as those are known to diversify risk exposure.

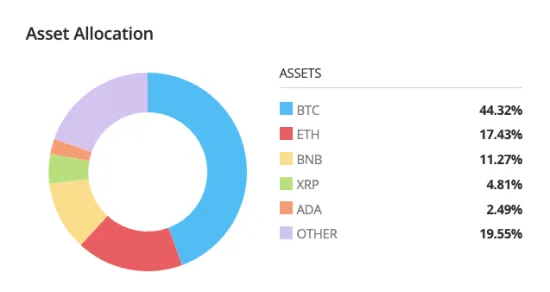

In crypto, diversification also finds a more or less valid application as investing in many different coins heavily lowers the risk of total losses, while maintaining a decent exposure to the crypto market.

For crypto beginners who feel comfortable taking moderate risks, a crypto ETF with a decent portion invested in Bitcoin may represent a perfect compromise between sticking to just Bitcoin and risking one's entire capital on altcoins.

Anyone just getting started with cryptocurrencies has the option to effortlessly invest in such managed, diversified crypto portfolios on chosen crypto trading platforms, such as eToro or

Bitpanda .

With a suitable crypto savings plan, this can even be done automatically – for example, through a monthly standing transfer – and is therefore a particularly suitable method for getting started with cryptocurrencies.

Note: It's possible to imitate a crypto index by manually buying the cryptocurrencies in the same allocation on any exchange of your choice, but especially for investors just beginning with crypto, this leaves some extra room for errors.

Investing in specific cryptocurrencies

Despite the fact that the methods to start investing in cryptocurrencies mentioned in our crypto starters guide may mitigate the relative risk exposure, some crypto beginners may only be interested in the risky way of crypto investing, which is trading hand-picked altcoins with the hope of being ahead of the markets.

While investing in specific altcoins has an exceptionally high-profit potential, compared to getting started with just Bitcoin or diversified crypto indices, this approach requires a lot of experience and may not be recommended for pure crypto beginners that haven't gained enough knowledge and experience yet to know what it takes to properly analyze a crypto project.

If you're interested in learning crypto in-depth to be able to perform independent research on specific crypto projects, there is a long learning path ahead of you. The following may be a good starting point from this crypto beginner guide:

What makes a cryptocurrency decentralized?

What are smart contracts?

What is DeFi?

What is Tokenomics?

Past crypto collapses and what you can learn from them

4. Securely store your crypto

Cryptocurrencies are very unique when it comes to the custody of assets, as owners of crypto have one single password - the private key - that grants full access to all your cryptocurrencies associated with it.

Generally speaking, after you have purchased cryptocurrencies on an exchange or a broker, you have major options for dealing with custody of those coins: you either leave the coins on the respective trading platform and don't deal with self-custody at all, or transfer your newly purchased coins to your personal crypto wallet in order to have full control over your assets.

| Custody Option | 💭 Opinion | ✅ Pros | ❌ Cons |

|---|---|---|---|

| Leaving coins on the trading platform | 😐 | Low risk of making mistakes | Risk of hacks, No control over your assets |

| Withdrawing coins to a personal software wallet | 👍 | Full control over your assets | Risk of hacks |

| Withdrawing coins to a personal hardware wallet | 👍 | Full control over your assets, very high security | Costs money |

While simply leaving your cryptocurrencies on the trading platform they were bought on may be a temporary solution with moderate security, an essential point of our crypto beginner checklist is to understand that you do not truly own your cryptocurrencies until you transfer them from the exchange to your own crypto wallet.

Crypto Wallets

A crypto wallet can be seen as a management tool for receiving, sending, and storing cryptocurrencies and can either be a simple software installed on your device or a specialized hardware device.

In essence, software wallets and hardware wallets fulfill the same task, with the major difference that while a software wallet stores your private key directly on your device that could get compromised by a virus, a hardware wallet stores that private key internally on a secure device that never leaks it out to any externally connected devices.

This makes hardware wallets way more secure, and hence highly recommended to anyone with a significant investment in cryptocurrencies.

If you're just learning how to get started with cryptocurrencies on the other hand, you may find it unappealing to spend a lot of money on a hardware wallet, in which case a software wallet like the ones listed below will do just fine:

Universal, free Software Wallets suitable for beginners

Exodus Wallet (desktop & mobile)

Trust Wallet (mobile only)

BitPay (mobile only)

These software wallets are so-called non-custodial or self-hosted wallets, which means that you alone have access to cryptocurrencies sent to them. Many other software wallets on the other hand are custodial solutions that should be avoided by crypto beginners in most cases.

Backup your Private Key

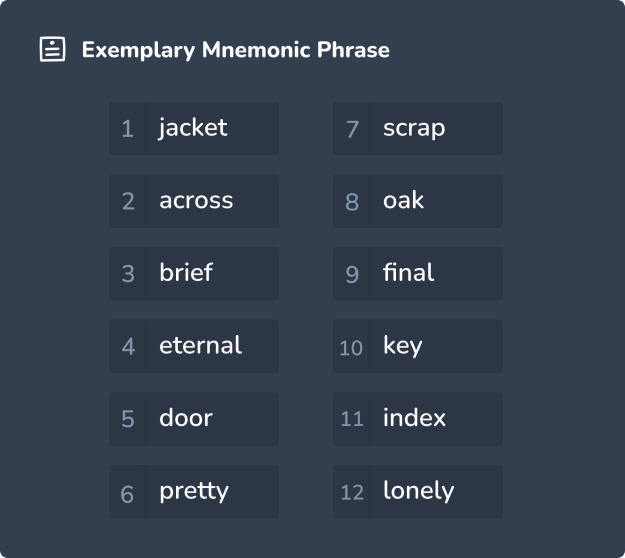

If you should make the decision of storing your cryptocurrencies in your own crypto wallet, one of the first things you'll face when setting it up is a so-called mnemonic phrase consisting of a unique combination of 12 or 24 words representing your private key, which is the password for accessing all of your crypto assets.

Before beginning to transact with crypto on your personal wallet, your personal mnemonic phrase generated from your wallet should be physically written down - e.g on a piece of paper or engraved in metal - and stored in a highly secure place.

One of the most dangerous crypto beginner mistakes in this regard is storing the mnemonic phrase in digital form on a computer, smartphone, or similar, as that may result in a hacker gaining access to your crypto.

Storing one's own mnemonic phrase is the first experience with the responsibility that comes with crypto's self-custody for any investor beginning with cryptocurrencies. Understanding how self-custody on blockchains works marks a key step for every crypto beginner that should never be rushed, as it may result in the worst mistakes you can imagine.

We have explained the concept of private keys and self-custody in our Bitcoin guide, which is a great follow-up resource for crypto starters.

5. Dealing with Volatility

When starting to invest in cryptocurrencies as a beginner, it's a given that sooner or later you will experience crypto's above-average volatility - either through a big market surge or crash.

Market Crashes

A fundamental lesson that most crypto investors learn throughout different market cycles is that when investing in crypto long-term, short-term price crashes may be stressful at first, but can even be appreciated if they are caused by market psychology and not by factual flaws.

This is because psychologically-caused crypto crashes allow investors who believe in the long-term success of crypto to accumulate more cryptocurrencies for a cheaper price, resulting in great profits if the specific coin should ever go back to its original price.

Exactly that is a popular investing strategy realized via a cryptocurrency savings plan, also called automatic DCA, which can be set up on exchanges such as Bitvavo . Such an automatic plan allows investors to purchase cryptocurrencies in regular intervals, without paying attention to current prices.

We have already covered the pros and cons of the crypto DCA strategy in great detail in a separate post.

However, keep in mind crashes caused by actual incidents or other negative news that objectively reduce the value of the specific cryptocurrency are an inherent, serious risk in the crypto world that everyone starting to trade crypto should be aware of, with the only potential protection being diversifying one's crypto investments.

Take Profits

For anyone getting started with cryptocurrencies, it's important to not only have a plan for how to behave in times of falling markets but also during rising markets, which is another essential piece of advice in our crypto beginner checklist.

Although completely ignoring the markets and simply keep buying crypto may be a valid approach for long-term passive investors who believe cryptocurrencies will replace the current monetary system, most beginning crypto investors want to achieve profits in their local currency, which obviously requires selling their crypto at some point.

During bull markets where prices keep rising, it's never a bad idea to gradually take profits because the market direction could drastically change at any time.

This is due to the reason that during bull markets, especially for crypto beginners who haven't been through one yet, it's very easy to become greedy, ending up not selling any of one's crypto before the bull market turns around to the downside.

Practical tip: Define clear target crypto prices right from the start, at which you can gradually begin taking profits, while considering potential tax implications.

Profiting from cryptocurrencies takes us to another essential aspect that cannot be left unmentioned when talking about getting started with cryptocurrencies, and that is Crypto Taxes.

6. Consider Taxes

Depending on your residence, different types of taxes on profits from cryptocurrencies may apply, which every investor starting with crypto trading should be aware of.

Some mentionable commonalities regarding crypto taxes across the world and pieces of advice for beginning crypto investors are:

In the vast majority of legislations, profits from selling or swapping crypto as well as receiving any form of crypto rewards are considered capital gains or income

If you're not trading commercially, you most likely have to file your crypto taxes for every single year

Luckily, there are many beginner-friendly crypto tax tools that allow you to document all of your crypto transactions and work together with regional tax consultants to create final tax reports for you:

Beginner-friendly crypto tax tools and services

Most of these tools allow you to register and start using their documentation software for free, which everyone learning how to begin with crypto should do from the very beginning of their crypto investing journey to avoid work stacking up towards the end of the year.

Personal experience advice: It really helps to record every single crypto transaction on an ongoing basis with suitable software so that any potential questions from (financial) authorities can be answered quickly and without much effort. If, on the other hand, you choose to not use a crypto tax app, it will be almost impossible to track and identify your transactions after just a few months or years.

For detailed information regarding crypto taxation in a specific country, everyone who's getting started with crypto should either conduct some proper, independent research or contact a tax professional for a smooth start in investing in crypto.

Final words

Despite the fact that the above crypto beginner checklist may help beginners get an initial orientation into the process of getting started with cryptocurrencies, learning crypto is not requires a lot of time and profound research.

We cover many fundamental crypto topics here on blockig that explain to beginners how to get started with crypto from the ground up, but it's really important for every beginning crypto investor to additionally research and educate themselves in many different ways. There are many online resources available, including blogs, forums, and YouTube videos, that can help you progressively learn more about cryptocurrencies along the way.

Also, While passive investing in crypto and not caring about market conditions is a totally valid strategy, most crypto beginners who have learned the basics of how to get started with crypto will want to follow the price and market developments to stay up-to-date:

Staying up to date

Keeping an eye on crypto prices