Exchanges with Automatic Crypto DCA Compared

Given the volatility of cryptocurrencies, many investors are seeking to reduce the risk of an immediate crash by chunking their investments instead of risking everything at once.

This strategy of auto-investing smaller amounts in cryptocurrencies over a longer period of time is called crypto DCA, also known as a crypto savings plan or recurring crypto buys.

To auto-invest in cryptocurrencies, users can make use of dedicated cryptocurrency exchanges that support such recurring crypto purchases.

On those platforms, users either deposit funds manually or authorize a recurring charge with any payment method, and let the platform automatically invest in cryptocurrencies for them periodically - e.g. once a month.

We have tested numerous such crypto savings plans and rated their trading fees, minimum savings rate, and more, helping you to decide where to do automatic crypto DCA.

1. Bitpanda: Crypto Savings Plan

The European multi-asset broker Bitpanda offers a beginner-friendly savings plan for all sorts of assets, including cryptocurrencies, stocks, and metals.

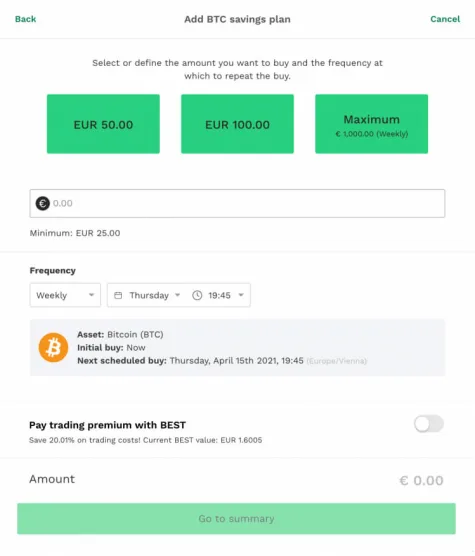

On Bitpanda, users can automatically DCA into 535+ different cryptocurrencies and 2149+ stocks with as low as 25€ per trade.

The Bitpanda savings plan can be executed daily, weekly, or monthly, and supports functionality to define a specific day time at which the assets are purchased.

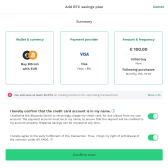

Luckily, Bitpanda's recurring buys come with no additional costs and can be set up with credit cards or SEPA bank transfers in a few easy steps:

Register and verify yourself on

Bitpanda

Navigate to Trade → Savings plan and select your cryptocurrency

Select your local currency and payment method

Enter your amount and DCA interval

Click Go to summary and confirm your savings plan

When doing automatic crypto DCA on Bitpanda, the default order fees of 0.99% apply, which are rather moderate compared to 0.02-0.25% for manual purchases on Bitpanda Pro .

2. Kraken: Recurring buys

The international cryptocurrency exchange Kraken offers automatic DCA into 450+ cryptocurrencies on their mobile app, with amounts as low as 10$ per order.

Kraken's recurring buys feature supports daily, weekly, biweekly, or monthly DCA intervals, as well as the option to define a specific order time.

You can set up automatic crypto DCA on Kraken in a few steps:

Download and open the

Kraken App on your phone

Verify your account by providing some personal details

Select any cryptocurrency and click Buy

Tap on Buy Frequency and choose your DCA interval

Select your payment method and confirm the order

Automatic DCA on Kraken can be paid for using automatic credit card charges, or via your Kraken account balance that you can manually top-up with: Bank transfers, VISA, Apple Pay, Mastercard, and Google Pay.

It's important to mention that recurring crypto buys on Kraken come with a higher fee of roughly 1%. For those who want to save on fees, crypto DCA can also be done manually on Kraken Pro with fees of only 0-0.4%.

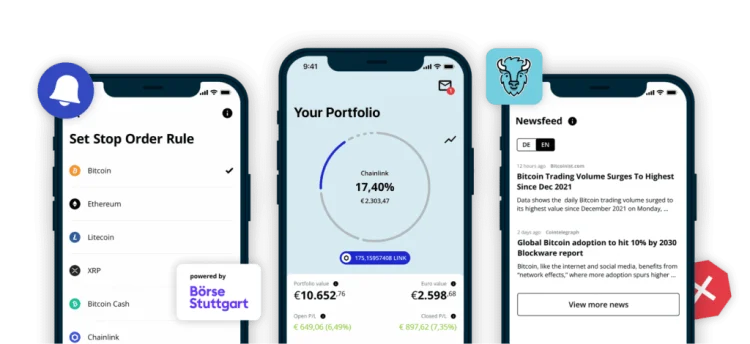

3. Bison App: Crypto Savings Plan

The European crypto broker Bison offers the cheapest crypto savings plan from our test, with fees of up to 1.25%.

On Bison, investors can automatically dollar cost average into 17+ cryptocurrencies, including all major coins like Bitcoin, Ethereum, and Cardano.

The recurring crypto investments on Bison can be executed weekly, monthly, and quarterly, and has no minimum execution amount - meaning you can get started with 0.01€ per DCA order.

To set up automatic crypto DCA on Bison, follow the following steps:

Register and verify yourself on

Bison

Open the Bison App or visit the web version on your desktop

Deposit funds via one of the available options: Apple Pay, Google Pay, and Bank transfers

Navigate to Manager → New Savings Plan

Select your cryptocurrency, DCA interval, and DCA amount

Review and confirm your auto-invest plan

Because the crypto auto-invest feature of Bison charges you directly from your account balance, you can set up a SEPA standing order at your bank, or manually top-up your account every now and then to ensure you have enough funds.

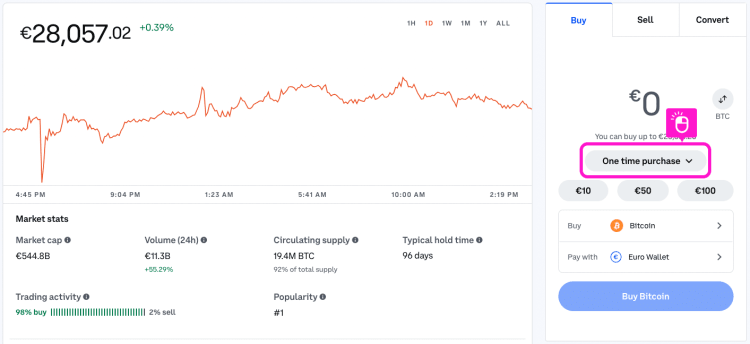

4. Coinbase: Recurring Buys

With its recurring buys feature, the popular crypto exchange Coinbase allows users to DCA into 230+ cryptocurrencies with amounts as low as 1.99$.

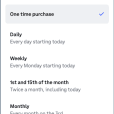

One unique feature of automatic crypto DCA on Coinbase is the ability to pay with PayPal in certain regions. Furthermore, Coinbase supports similar DCA intervals as other crypto savings plans: daily, weekly, biweekly, and monthly.

To set up recurring crypto purchases on Coinbase, simply

Register and verify on

Coinbase

Select a cryptocurrency

Select Buy → One time purchase

Choose your DCA interval

Choose a payment method if you haven't deposited funds already

Review and confirm your savings plan

Just like other cryptocurrency exchanges with DCA, crypto auto-invest on Coinbase comes with higher fees for instant trading of 1%.

Once again, it would be more efficient to do manual crypto DCA on Coinbase Advanced with fees of only 0-1.2%.

Benefits of Crypto Exchanges with DCA

To truly execute the DCA strategy consistently and not let one's emotions get in the way, it's good to automate the buying process, which is where automatic crypto savings plans come into play.

Crypto exchanges with DCA are useful for passive crypto investors who do not want to spend time actively trading and tracking cryptocurrencies, but would rather just set up an automatic savings plan once and simply forget about it.

This allows users to regularly invest in crypto - no matter the price - and not worry about market conditions.

Hence, the major benefits of doing automatic crypto DCA on dedicated exchanges are convenience and consistency, two important factors for anyone who is not into crypto full-time.

Fees of automatic Crypto DCA

Unfortunately, it's very common for crypto exchanges with DCA to charge users higher trading fees for their savings plans compared to manually trading on their advanced interfaces.

For beginners who would not make use of advanced trading interfaces anyway, the higher fees of automatic crypto DCA don't really matter.

However, if you want to get the most out of your investment, we generally recommend doing manual crypto DCA on exchanges.

Meaning: you log into any cost-efficient crypto exchange of your choice periodically - e.g. once a month - and purchase crypto manually instead of using the savings plan feature.

This method combines the best of both worlds, allowing you to execute your own crypto savings plan and benefit from low fees at the same time.

Automatic Crypto DCA Scripts

To fight the higher fees of crypto auto-invest on exchanges like Kraken and

Bitpanda , users came up with the idea to create scripts that automatically buy crypto in intervals for them.

Such scripts allow users to reap the benefits of crypto DCA, and at the same time keep trading fees at the lowest levels.

For smaller amounts, automatic crypto DCA scripts can be a valid solution, however, they involve a risk of bugs and hacks that can make you lose your money.

This is because dollar cost averaging into crypto on exchanges with scripts requires users to provide their private API keys which gain the script full access to your trading account.

Therefore, we don't recommend this method for executing a crypto savings plan to beginners.

Is Now a Good Time to Start Crypto DCA?

In theory, it's always a good time to start with automatic crypto DCA because the strategy is based on not trying to time the market.

As the famous saying goes:

Time in the market beats timing the market.

Automatic, recurring crypto investments allow you to purchase cryptocurrencies at an average price over the entire investing period, meaning you gain exposure to the crypto markets and benefit from rising prices but also don't get too affected by market crashes.

This makes crypto savings plan a generally good long-term option to start saving in crypto under any market conditions.