Bitpanda vs eToro Compared for 2025: Which Broker is Better?

Bitpanda and eToro are two highly popular multi-asset brokers with comparable trading offerings, ranging from cryptocurrencies to stocks, ETFs, and more.

In our head-to-head comparison of eToro vs. Bitpanda, we compare how these two brokers perform in several important factors. This should help you to personally answer the question of who is better: Bitpanda or eToro?

Registration and Verification

While Bitpanda and eToro both offer an account registration that takes just a few minutes on average, there is a notable difference when comparing their specific verification procedures.

eToro often offers registration that only involves answering some personal questions, while Bitpanda requires users to verify their identity through a video call or similar during registration.

In our comparison, the registration on eToro was faster and more convenient than on Bitpanda.

This resulted in eToro being rated with 93/100 points and Bitpanda with 90/100 points for their registration speed.

Tradable Assets: Bitpanda vs eToro

As multi-asset brokers, Bitpanda and eToro compare very similarly when it comes to the selection of tradable assets.

This is because both Bitpanda and eToro allow users to trade everything from stocks and ETFs to cryptocurrencies and commodities.

| Bitpanda | eToro | |

|---|---|---|

| Cryptocurrencies | Yes | Yes |

| CFDs | Yes | Yes |

| Crypto Indices | Yes | Yes |

| Derivates | Yes | Yes |

| ETFs | Yes | Yes |

| Precious Metals | Yes | Yes |

| Stocks | Yes | Yes |

| Forex | No | Yes |

Until recently, eToro had an advantage over Bitpanda because it offered CFD trading, allowing risky leverage and short selling.

However, in mid-2023 Bitpanda also expanded its trading offerings to include CFDs, fully catching up with eToro's offering.

Crypto and Stocks

While eToro and Bitpanda have a nearly identical offering of tradable assets, we found that Bitpanda's cryptocurrency offering is better, while eToro is slightly better for stocks and ETFs.

This is because Bitpanda has a total of 535+ cryptocurrencies listed on their platform, while eToro only has 134+ available coins. Also, Bitpanda has the dedicated cryptocurrency trading interface Bitpanda Fusion with low trading fees, which eToro cannot compete with as a simple crypto broker.

In return, eToro offers fee-less trading for a slightly larger selection of 3624+ stocks compared to 2149+ stocks on Bitpanda. On both platforms, however, users only invest in derivates that follow the prices of stocks, without actually owning real stocks.

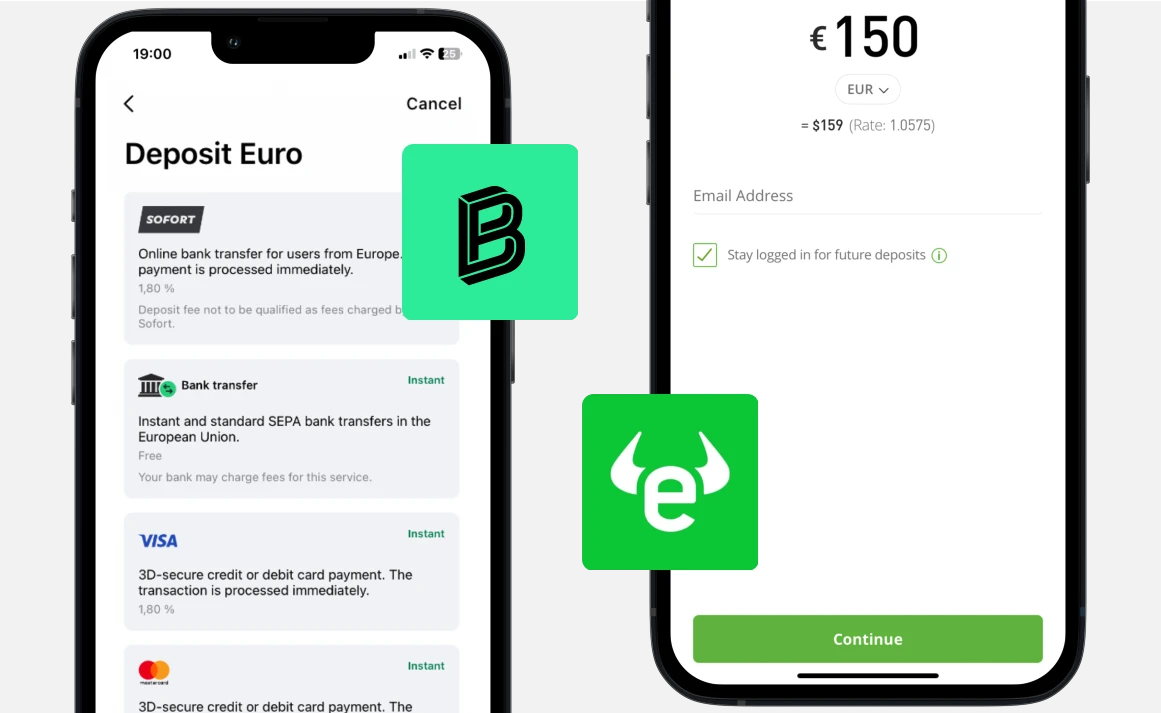

Payment Methods: Bitpanda vs eToro

The available deposit methods mark an important difference in the comparison of eToro vs. Bitpanda.

While Bitpanda has mostly common deposit methods that are limited to supporting only a few currencies, eToro shines with lots of third-party payment providers like PayPal. Thus, eToro lives up to the image of a diverse multi-asset broker more than Bitpanda.

| Bitpanda | eToro | |

|---|---|---|

| Bank Transfer | Yes | Yes |

| Mastercard | Yes | Yes |

| VISA | Yes | Yes |

| Klarna | Yes | Yes |

| GiroPay | Yes | No |

| Bank transfers | Yes | Yes |

| Skrill | Yes | Yes |

| PayPal | Yes | Yes |

| Przelewy24 | No | Yes |

| Poli | No | Yes |

| Payoneer | No | Yes |

| Trustly | No | Yes |

This may make it easier to get started trading on eToro compared to Bitpanda, especially for foreign investors with less popular currencies.

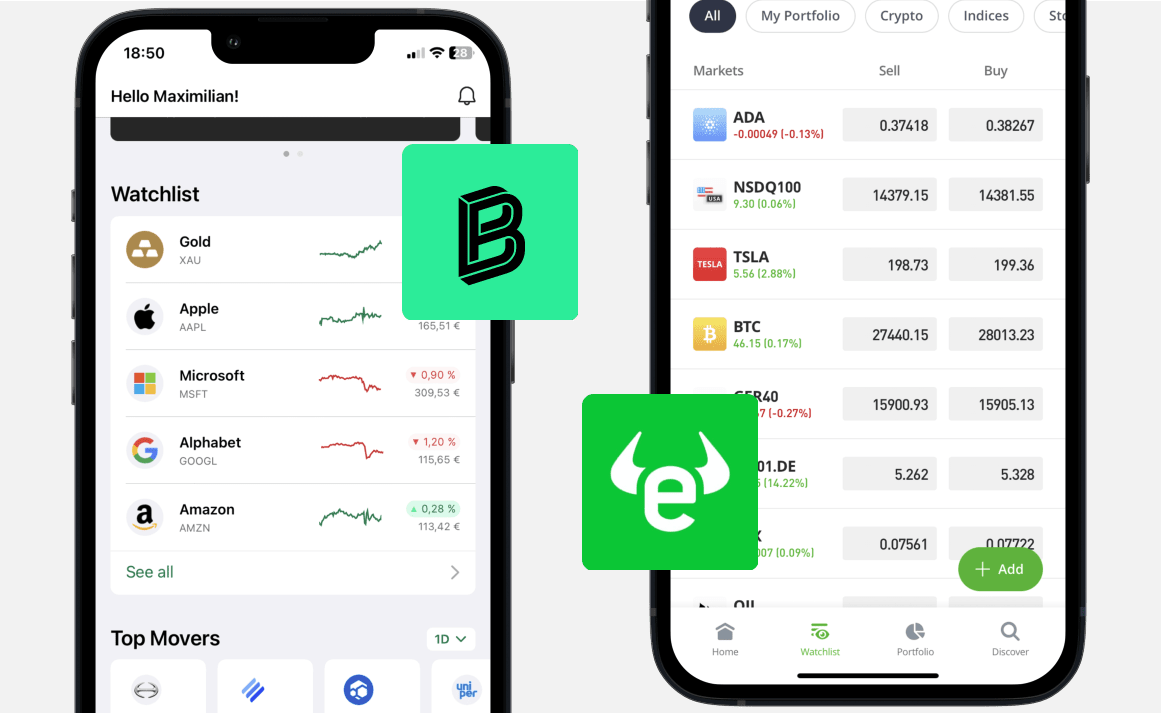

Trading Platform: Bitpanda vs eToro

The two compared brokers Bitpanda and eToro are particularly known for offering a quick and easy start to investing on both desktop and mobile devices.

We believe that beginner friendliness is a major benefit of both the compared brokers. This is because Bitpanda and eToro offer trading of cryptocurrencies, stocks, and ETFs in an easy mode that has a very beginner-friendly interface.

However, for more advanced investors, we found notable differences in terms of trading features and complexity in this comparison of Bitpanda vs. eToro:

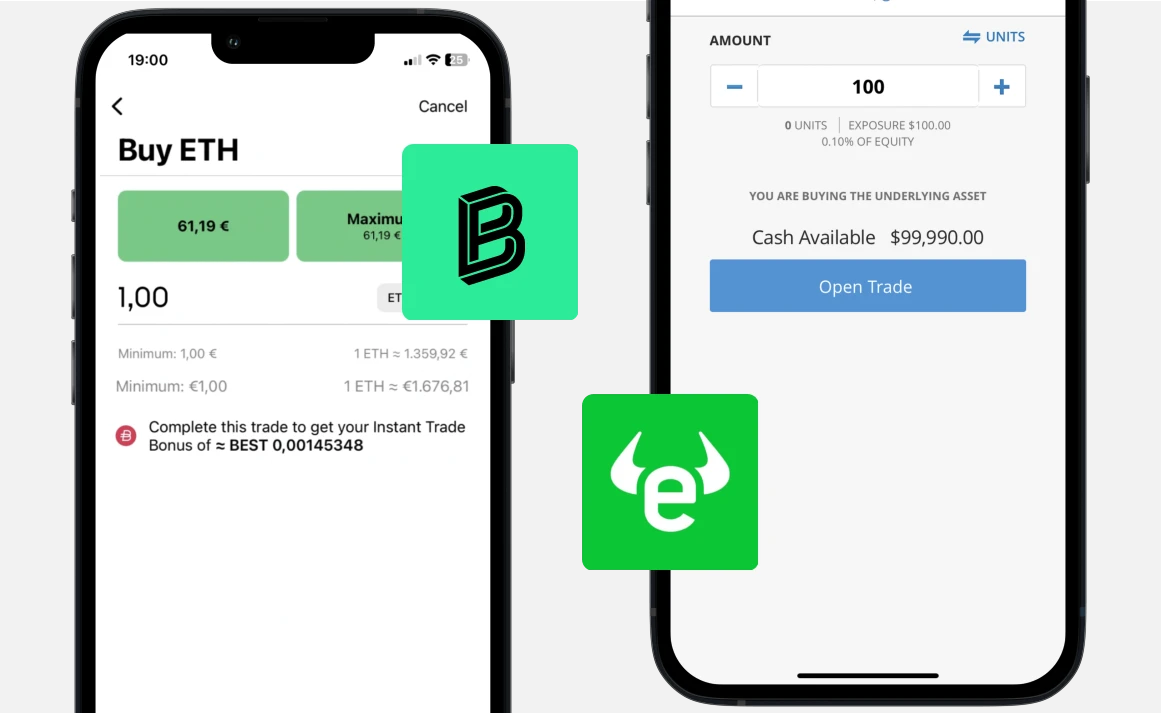

Order-Types

While eToro allows users to execute limit orders and automatically take profits or mitigate losses for all tradable assets, Bitpanda by default only offers simple market orders for all assets other than cryptocurrencies traded on Bitpanda Fusion.

This means that trading all assets besides cryptocurrencies is generally more advanced on eToro but slightly easier to navigate on Bitpanda.

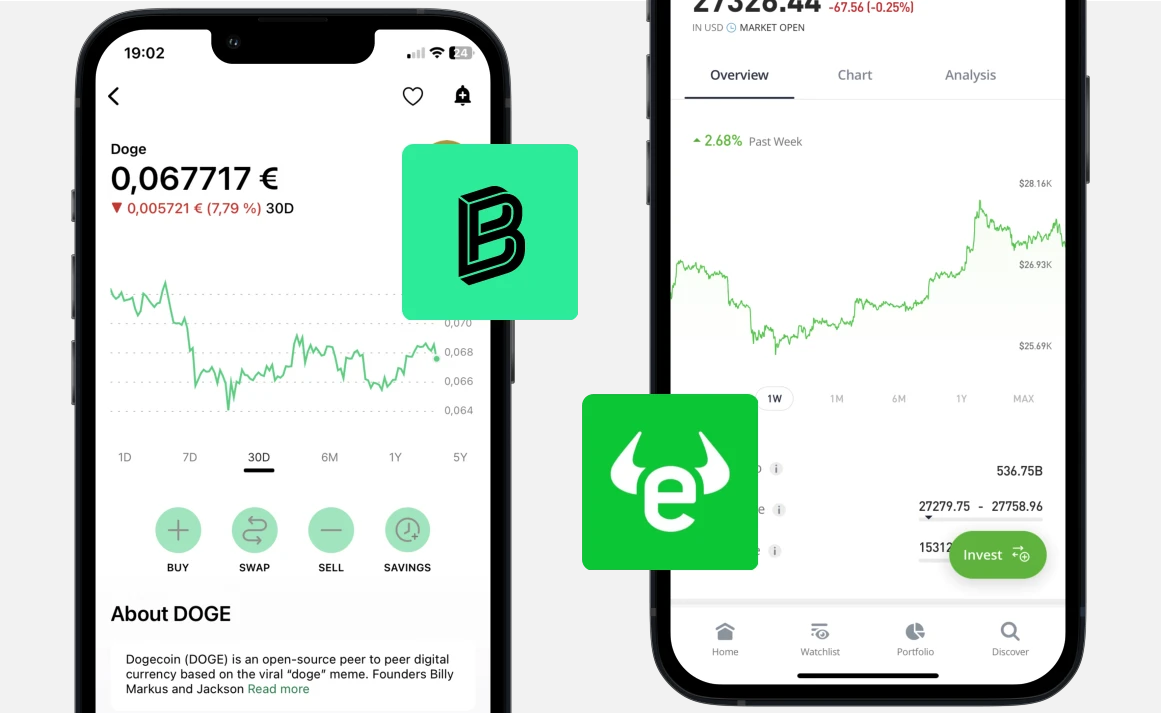

Trading Cryptocurrencies

Despite being more beginner-friendly than eToro, Bitpanda offers more advanced crypto trading with its dedicated cryptocurrency trading interface Bitpanda Fusion .

This, in return, makes Bitpanda a lot more functionally rich and cost-efficient than eToro for experienced crypto investors.

Where is trading better: at Bitpanda or eToro?

Ultimately, we find trading on Bitpanda to be slightly better than eToro in terms of user experience with both a simpler user interface as well as advanced crypto trading with Bitpanda Fusion.

On the other hand, eToro offers social- and copy trading, allowing users to copy the investments of others without any extra fees, while Bitpanda doesn't. Users wanting to make use of that feature should choose eToro over Bitpanda.

Fees: Bitpanda vs eToro

In terms of trading fees, there are major differences when comparing eToro vs. Bitpanda, depending on the traded asset.

When trading cryptocurrencies, Bitpanda has a fixed fee of 0.99% that is slightly lower than eToro's fee of 1%.

On

Bitpanda Fusion , however, only small crypto trading fees of 0.02-0.25% apply, making Bitpanda better than eToro for cryptocurrency traders.

For stocks and ETFs,

eToro has €1-2 order costs, or no fees at all, while Bitpanda has rather high fees of ~0.7% or more.

The trading fees on eToro are often lower than on Bitpanda for stocks, ETFs and commodities. When it comes to cryptocurrencies in easy mode, both platforms offer similar fees.

Trading Fees: Bitpanda or eToro?

Overall,

eToro performs better than Bitpanda when it comes to trading fees across all sorts of assets.

For those interested solely in trading cryptocurrencies, the fees of

Bitpanda Fusion make Bitpanda a far better option than eToro.

Account-related Fees

Besides trading fees, the comparison of eToro vs. Bitpanda reveals some differences in the fees related to maintaining an account:

eToro charges a small inactivity fee for users that haven't traded for over a year, while Bitpanda charges no inactivity fee at all.

Withdrawing money from eToro to your bank account comes with a small service fee, which is not the case for Bitpanda

Withdrawing cryptocurrencies comes with fees on both eToro and Bitpanda - but they are significantly lower on Bitpanda

This makes Bitpanda far better than eToro in terms of account-related fees. In practice, this does not outweigh the lower trading fees on eToro, making

eToro the overall comparison winner in terms of fees.

Legitimacy and Regulations: Bitpanda vs eToro

A common advantage when comparing Bitpanda vs. eToro is regulatory legitimacy, as both brokers are regulated in the regions in which they operate.

Both Bitpanda and eToro now hold a 🇪🇺 MiCAR license, which is valid across Europe.

MiCAR (Markets in Crypto-Assets Regulation) not only regulates the trading of cryptocurrencies but also covers the custody of crypto-assets. Any platform that holds or manages crypto-assets on behalf of third parties must be authorized as a so-called Crypto-Asset Service Provider (CASP). MiCAR requires clear rules on the segregation of customer funds and regular asset reporting.

Bitpanda handles the custody of cryptocurrencies itself and holds a German BaFin license for crypto custody and proprietary trading — one of the strictest approvals in Europe.

With the acquisition of custody provider Trustology, now Bitpanda Custody, Bitpanda has built its own infrastructure with high security standards and external audits.

eToro takes a different approach: the actual custody of crypto assets is not handled by the broker itself but by its subsidiary eToroX, which holds a DLT license from the financial regulator in Gibraltar.

While Bitpanda Custody is directly integrated into the platform and monitored by European regulatory authorities, eToro relies on an outsourced custody structure through its subsidiary.

This makes Bitpanda a tiny bit more transparent over eToro when it comes to asset custody and safety.

| Bitpanda | eToro | |

|---|---|---|

| 🇩🇪 BaFin | Yes | No |

| 🇦🇹 FMA | Yes | No |

| 🇪🇺 MiCAR | Yes | Yes |

| 🇦🇺 ASIC | No | Yes |

| 🇨🇾 CySEC | No | Yes |

| 🇬🇧 FCA | No | Yes |

| 🇺🇸 FinCEN | No | Yes |

Comparison Winner: Bitpanda or eToro?

Both Bitpanda and eToro make great brokers that are suitable for beginning crypto, stocks, and commodity investors - and both come with a set of pros and cons.

The following individual ratings we assigned in this comparison will help you answer the question of whether the broker eToro or Bitpanda is better for you:

| Bitpanda | eToro | |

|---|---|---|

| Account Opening | 90% | 93% |

| Available Coins | 96% | 90% |

| Trading Fees | 90% | 89% |

| Beginner Friendliness | 92% | 91% |

| Features | 94% | 96% |

| Final Rating | 92% | 91% |

In our comparison of Bitpanda vs. eToro, the eToro broker has been shown to be great for beginning to intermediate investors that are interested in trading stocks and cryptocurrencies.

Bitpanda on the other hand performs better than eToro for advanced crypto traders who can benefit from the low fees of the dedicated cryptocurrency trading interface Bitpanda Fusion.

As a final result, Bitpanda was rated with 92/100 in comparison to eToro with 91/100.

The Bitpanda broker is our overall comparison winner and hence slightly more recommended than eToro.