If you've been around the world of cryptocurrency investing for a while, you certainly have come across the term crypto DCA in relation to investing.

Dollar cost averaging, or DCA, is a highly popular investment strategy that is all about buying cryptocurrencies regularly, without caring about the current prices of the crypto markets.

We will discuss the pros and cons of crypto DCA, how exactly crypto DCA works, and on which platforms you can dollar cost average into cryptocurrencies automatically.

What is DCA in Crypto?

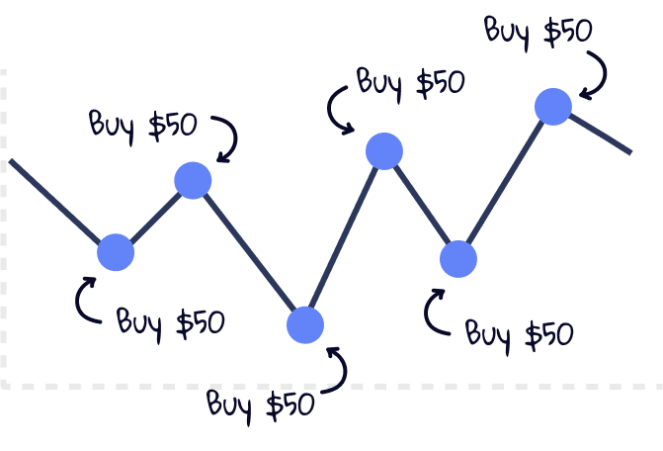

Crypto DCA stands for dollar cost averaging into cryptocurrencies and means automatically buying cryptocurrencies in regular intervals, such as daily, weekly, or monthly, no matter the current market prices.

The purpose of the crypto DCA strategy is to buy cryptocurrencies at an average price over the investment period. This approach helps reduce the risk of buying during unfavorable market conditions, such as right before an upcoming crash.

Automatic crypto dollar cost averaging can be carried out on suitable crypto exchanges. On these platforms, you set up your personal DCA strategy once, and regularly dedicate a fixed amount of money to it, most commonly once a month, that automatically gets invested into crypto.

What's the effect of Crypto DCA?

Because by using the crypto DCA strategy you regularly buy the local highs as well as lows of the crypto markets, you end up investing at approximately the average price of the entire savings period in which dollar cost averaging was performed. This has a significant impact on how market volatility affects your investment:

By investing in cryptocurrencies through dollar cost averaging, you effectively lower the variance in your investment returns because you are buying at different points in time and reducing your exposure to market volatility.

In practice, this means that dollar cost averaging smoothes out the volatility of the cryptocurrency markets and potentially provides more stable and predictable returns over time.

DCA is still not a guarantee of returns, but the regular, systematic investment approach of crypto DCA can reduce the impact of short-term market volatility and help provide a more predictable path for long-term investment growth compared to a simple lump sum investment.

Crypto DCA lowers the risk of an investment but limits its upside. In contrast, investing everything at once provides higher upside potential, but also a way higher risk of losses due to unfortunate timing.

If you want to see the effect of crypto dollar cost averaging in practical examples, feel free to try out our crypto DCA calculator to compare the performance of past crypto DCA with your custom buying amounts and intervals for all sorts of different cryptocurrencies.

A profound answer to whether it's worth doing crypto DCA depends on various factors and leads us to all the pros and cons of the crypto dollar cost average strategy.

Pros of Crypto DCA

The reason why the crypto dollar cost average (DCA) strategy is so popular, is that DCA heavily reduces the risks of unlucky market timing when investing in cryptocurrencies.

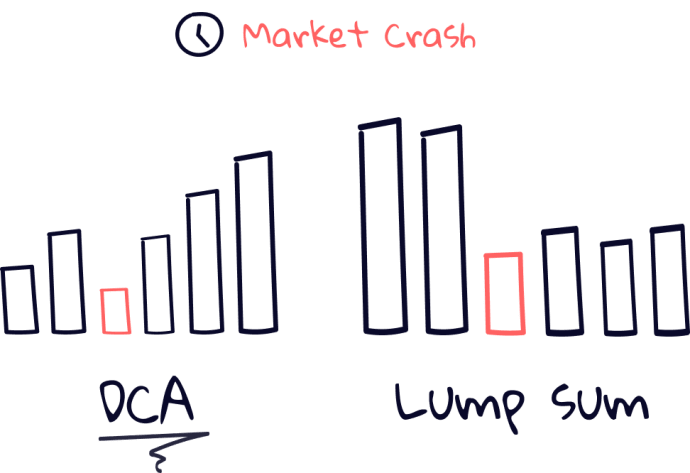

The risk mitigation of Crypto DCA is such an important advantage, that even if you would start investing right before a temporary market crash, you would lose less of your initial capital and at the same time accumulate more crypto as you would continue buying crypto at lower prices after the crash.

Hence, in the scenario of a temporary market crash, investing in crypto via DCA would have an enormous benefit over a one-time purchase as you effectively get more crypto for your money.

Many investors who dollar cost average into crypto are glad when bear markets (falling markets) occur, as they get to buy crypto at lower prices over a longer period.

There doesn't necessarily have to be an entire bear market in order to benefit from DCA. Small market corrections that temporarily cause prices to fall also allow you to benefit from DCA by buying crypto for cheaper prices.

Also, crypto DCA is perhaps the best investing strategy for beginners who would like to regularly invest in crypto but are fearful of making mistakes during the buying process, or have no time to regularly log into exchanges: With crypto DCA, you just have to put in the effort of setting up a recurring payment once and let the DCA plan handle the actual purchasing of crypto for you.

Another benefits that come with the crypto dollar cost average strategy is psychological: If you set up an automatic crypto DCA plan, you can stop being stressed about the market conditions.

Therefore, crypto dollar cost averaging also allows you to stop asking yourself "Should I buy now or wait?" which in return lowers the risk of FOMO and making bad, irrational decisions.

Cons of Crypto DCA

Just as with any other investing strategy DCA, or dollar cost averaging, also has a few disadvantages.

The biggest con of crypto DCA is the reduced potential of your investment because dollar cost averaging requires you to have money on the sidelines that you initially planned on using for investing.

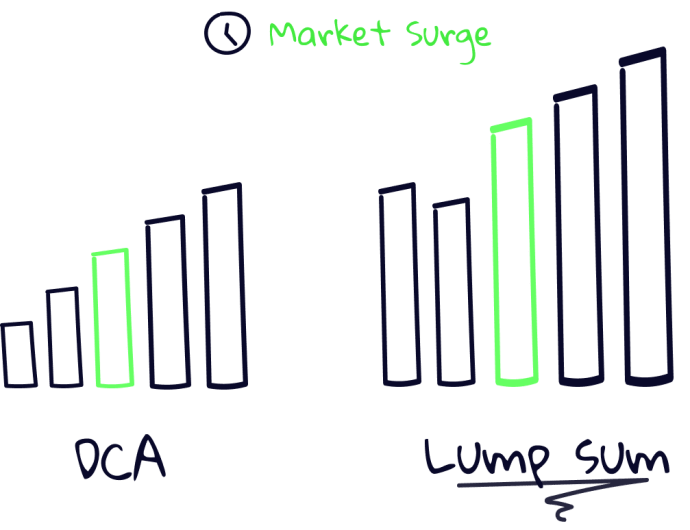

Therefore, if you were to start investing close before rising crypto prices, buying all the crypto you planned on owning in one go instead of chunking your investment via DCA would allow you to benefit from the price increase.

This is because, with the lump sum method ("buy all at once"), you would have no money waiting on the sidelines and have the capital that you reserved for crypto investing already fully exposed to the rising crypto assets.

During rising prices, a DCA investment would also be profitable, but in most cases significantly lower than a lump sum investment.

Another disadvantage of doing crypto DCA that arises for agile investors is that by purely dollar cost averaging, you cannot easily reach your desired exposure to the crypto markets that you initially planned, because you have to chunk your investments into small pieces.

Assuming you planned on allocating 5% of your entire investment portfolio into crypto, with a monthly crypto DCA, you would have to wait months if not years to reach that allocation.

Also, because DCA is a passive investing strategy, dollar cost averaging itself does not allow for easy portfolio rebalancing: Imagine you planned on having a 50% Ethereum and 50% bitcoin crypto allocation, but either of those would experience a big price drop. With DCA, you would keep buying both Ethereum and Bitcoin, even though one of them may potentially be already outweighing the other in your portfolio.

Crypto DCA or Lump Sum?

To decide whether crypto dollar cost average or Lump sum is a better investment strategy for you, you should understand how both these investment strategies compare in different market conditions.

Crypto DCA shines during bear markets where prices continue falling, while one-time investments (lump sum) perform better during bull markets where prices continue rising. During sideways market movements, both DCA and Lump sum often perform equally well.

Hence, dollar cost averaging into crypto is more often the better choice for people who'd like to save in crypto long-term throughout all possible market cycles and conditions and have a higher risk aversion. Most investors who choose the crypto DCA method like that DCA does a great job at accumulating crypto during bear markets as well as bull markets, which allows them to stay passive during all market conditions.

On the other hand, a lump sum investment can be the better choice for investors who feel more comfortable taking risks and believe in the long-term success of crypto ("every crash is temporary") or think of being able to time the markets.

For anyone who is still unsure of whether to use crypto DCA or lump sum investments, a hybrid approach that blends these two investing strategies may also be a solution.

A mixture of crypto DCA and lump sum can offer the advantages of both methods, enabling crypto investors to quickly gain exposure to the markets and take advantage of market corrections by buying manually from time to time ("buy the dip") while still benefiting from the passive, gradual investment approach of DCA by continuing to regularly save in crypto.

In any case, any decision on whether crypto DCA or lump sum is better requires careful consideration of your investment goals, time horizon, and personal risk tolerance.

A practical example of Crypto DCA

Imagine you had $1200 to invest in Bitcoin, but you were afraid of a potential crypto crash coming shortly that could erase a significant portion of your entire investment.

In this scenario, you may find it more appealing to not only get to buy crypto at the current, potentially high, prices but at the overall average prices that will occur over the next months.

Hence, what you could do, for example, is execute a monthly crypto DCA of $100 for one year, and automatically buy crypto for $100 on the 1st of every month.

After 12 months, your crypto DCA would have been finished, and you would have invested a total of $1200 at roughly the average dollar price of the entire 12-month period.

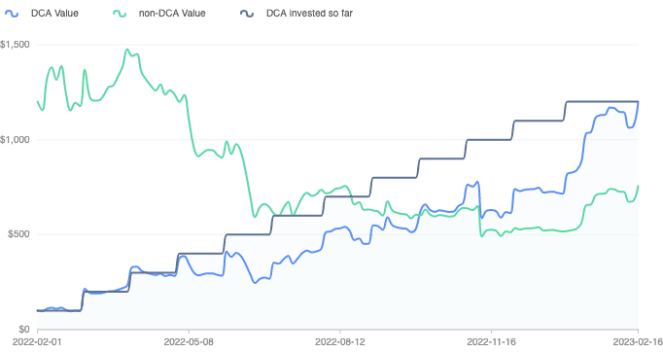

Assume you start your crypto DCA on the 1st of February 2022 and end it in February 2023, your investment would perform as follows according to our crypto dollar cost average calculator :

This exemplary crypto DCA scenario took place at a time when the cryptocurrency market had significant price drops.

And yet, even though dollar cost averaging reduces the potential upside, the DCA investment (in blue) would have reached break-even at the end of the investing period, while the lump sum investment (in green) would have resulted in a -40% loss.

Obviously, one could easily find contrary examples, especially during bull markets, but this crypto DCA example shows the power of crypto DCA in terms of risk limitations.

How to do automatic crypto DCA?

If you want to set up an automatic DCA that buys cryptocurrencies automatically once every X days you can use crypto exchanges that offer automatic DCA on their platform.

Crypto exchanges that support automatic DCA offer an easy interface with advanced options to realize your personal dollar cost averaging strategies, such as a custom DCA savings interval, a custom DCA saving amount, and more.

We have tested and rated many of the best crypto exchanges with automatic DCA that you can compare on this page.