What is Bitcoin?

Bitcoin is the world's largest and most well-known cryptocurrency that operates on a peer-to-peer network, allowing users to transfer money directly from user to user without the involvement of intermediaries such as banks or payment providers.

Instead of using fiat currencies such as the US-Dollar or Euro, the Bitcoin network has its own digital currency called bitcoin (BTC).

Besides being just a cryptocurrency, Bitcoin is a first-of-a-kind phenomenon of normal people successfully forming a global network with a digital form of money that has strictly defined rules that all network participants agree upon.

Over the past decade, Bitcoin has grown from an unknown experiment to a serious competitor of traditional money, with its market capitalization surpassing the $1 trillion line and its adoption spreading across the world, which is reflected in countries such as El Salvador making Bitcoin a legal tender in their country.

The native cryptocurrency of the Bitcoin network, the bitcoin, has been by far the best-performing asset in the past decade, going from a price of $0.02 in its early days, to reaching an all-time high of nearly $70,000.00 in November 2021.

| Name | Bitcoin |

|---|---|

| Symbol (Ticker) | BTC |

| Price | 84952.56$(+0.53% 24h) |

| Market capitalization | 1,684,420,924,805.0,027$ |

| All time High | 108786.00$ (Jan 20. 2025) |

| All time Low | 67.81$ (Jul 6. 2013) |

| Tradable on |

To securely and reliably manage such an independent global money network, the Bitcoin blockchain is put in place, which is a globally distributed database that publicly records all transactions ever made in Bitcoin.

In fact, Bitcoin is the first ever public project to successfully make use of blockchain technology, which has grown massively in popularity ever since.

Who created Bitcoin?

Bitcoin was created in 2009 by an unknown individual or group of individuals known as Satoshi Nakamoto, with the vision of providing digital, secure, and transparent money that operates independently of governments and centralized institutions with strict rules that cannot be arbitrarily changed.

Until today, the creator of Bitcoin remains unknown, which is one of Bitcoin's many strengths, as having no official creator makes Bitcoin money from the people for the people.

Bitcoin provides fair money for everyone equally. There are no creators or developers of Bitcoin that deserve any special treatment.

While Satoshi Nakamoto only brought the Bitcoin network to life, Bitcoin became successful due to thousands of volunteers joining and actively participating in forming this global network with its currency bitcoin whose rules they all agree upon.

Is Bitcoin Anonymous?

At its core, the identity of every user in the Bitcoin network is based solely on his receiving addresses that by default are not linked to the user's real-world identity.

A Bitcoin user can generate as many different receiving addresses as he'd like, making those addresses act as pseudonyms for the user, just like randomly generated usernames or email addresses.

As long as users of Bitcoin do not link their receiving addresses to their real-world identity, they can remain anonymous.

But, because many users buy their bitcoins on platforms that require them to verify their identity, many if not most of the Bitcoin transactions could be tracked down to actual personas, similar to accounts on social media that only seem anonymous on the surface. This is why Bitcoin is called a pseudonymous network.

Bitcoin users can also be tracked and de-anonymized in the future with potentially better technology because the Bitcoin blockchain stores all Bitcoin transactions forever.

Benefits of Bitcoin

Bitcoin was created during the 2009 financial crisis, in response to mismanagement and flaws of the traditional money system.

That's why, unsurprisingly, Bitcoin fundamentally differs in all major aspects compared to the traditional financial system, as Bitcoin attempts to address and remove all flaws of traditional money.

Both the network as well as the monetary rules of Bitcoin make this cryptocurrency a form of money with many benefits compared to normal money.

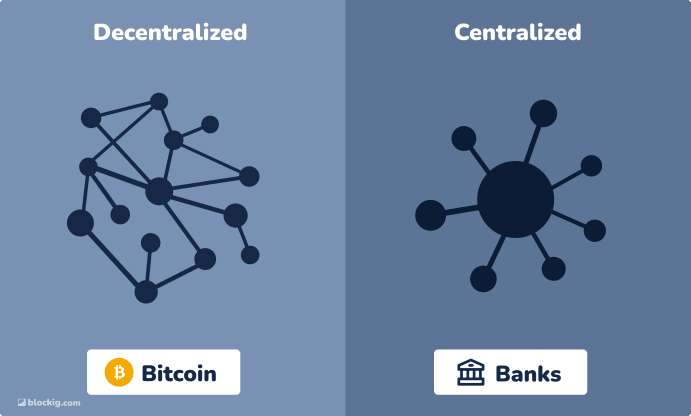

Decentralized

One of the distinguishing features of Bitcoin is that it operates on a decentralized network of globally-distributed participants, meaning there is neither a central authority nor organization controlling or making decisions over the Bitcoin network.

Bitcoin being decentralized means that

Transactions are conducted securely on a peer-to-peer basis (from user to user) and without intermediaries

Bitcoin cannot be shut down: If one node goes down, another one appears somewhere else around the globe

Only the users of Bitcoin decide all rules of the network including its native currency bitcoin.

This is in striking contrast to traditional money, which is issued, regulated, and controlled solely by national governments and central banks, which allows those centralized entities to influence markets and therefore the financial safety of entire nations with their decisions.

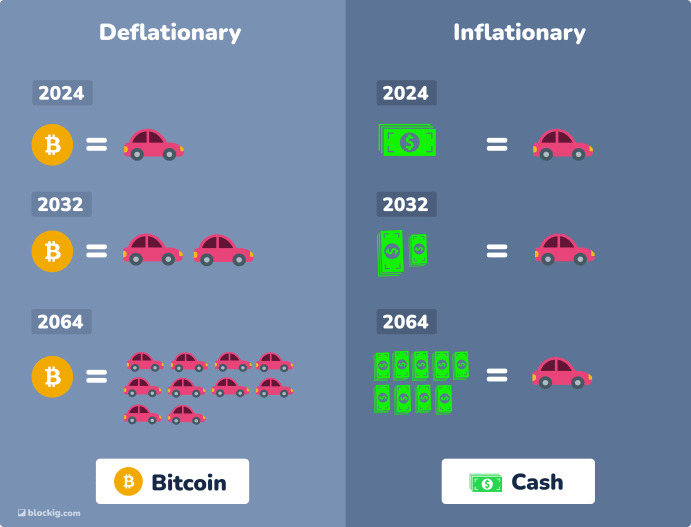

Deflationary

Another major benefit of Bitcoin compared to traditional money is bitcoin's process of creation:

Bitcoin has a limited supply of 21 million newly created bitcoins, and its creation rate decreases over time due to the so-called Bitcoin Halving, making it a fully deflationary currency.

This means that in theory, if Bitcoin would not lose any of its interest, the cryptocurrency Bitcoin should continue rising in value in the long run.

This is in fundamental contrast to traditional money, which is being issued in unlimited quantities by central banks, allowing governments to intervene in financial markets and is arguably one of the main drivers of inflation.

Being deflationary, bitcoin is a good store of value, as even all scarce physical assets, like gold or silver, may be inflated and devalued heavily at some point with the help of future technology.

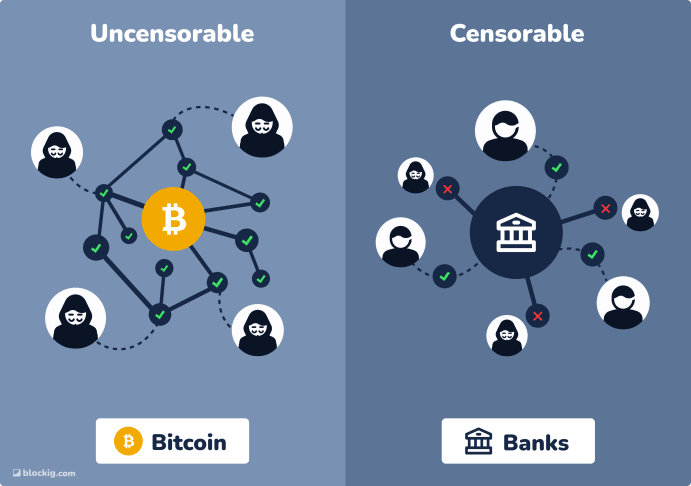

Uncensorable

One of the most significant benefits of Bitcoin's decentralized network is that it allows all its users to perform uncensored transactions, no matter the amount of transacted bitcoin or its sender or receiver.

This means that no one, except the independent Bitcoin network as a whole, can block or restrict transactions based on their amount, origin, destination, or content.

In contrast, traditional money is subject to a wide range of regulations, restrictions, and censorship by governments and financial institutions.

In the traditional financial system, it's cumbersome to transact high amounts of money or withdraw high amounts of cash.

In Bitcoin, you can send $1.000.000.000 just as easily and quickly as $1.

The uncensorable nature of Bitcoin allows any individual to be their own bank.

Trustless

Due to its transparency and verifiability, Bitcoin is a fully trustless system, meaning that users don't have to trust any central authority or intermediary to process their transactions or verify that they have indeed received payments from other participants.

Instead, transactions on the Bitcoin Blockchain are verified and processed by the network's nodes, including your own Bitcoin full-node, making it far more secure and transparent.

In comparison, traditional financial systems are built fully on trust. In the real world, one has to trust local banks and authorities to keep one's funds safe and available to use at all times. Additionally, one has to trust central banks and the overall economy to maintain the stability of the national currency.

How does Bitcoin work?

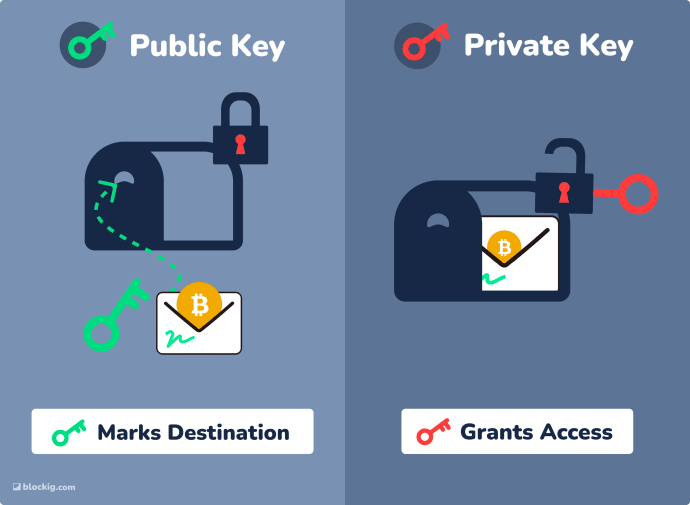

The main characteristic of Bitcoin is that sending and receiving bitcoins is fully based on asymmetric cryptography and does not require registering an account or entering any private information.

Instead, every Bitcoin user generates a pair of cryptographic keys that consists of a public- and a private key with the help of a Bitcoin wallet.

📫 A Bitcoin public key is used by users to generate their individual receiving addresses similar to an email or a postal address. The public key together with all generated receiving addresses can be safely shared with anyone who'd like to send bitcoins to you.

🔐 A Bitcoin private key acts as a unique password that gives the owner direct access to all the bitcoin sent to the corresponding public key, just like a password gives you access to all emails sent to your email address. It should never be shared with anyone and stored securely in a secret place.

In simple terms, users send bitcoins by simply decrypting their bitcoins with their private key and encrypting them with someone else's public key.

Even though a Bitcoin wallet with a public- and private key is all you need to use Bitcoin, there are many other components of the Bitcoin network that coordinate the sending and receiving of bitcoins.

Because Bitcoin is not just a regular application that lives on a single server, but rather a global network, Bitcoin needs to solve the following main problems:

Where and how do we document Bitcoin transactions securely?

How do all the thousands of Bitcoin participants all around the globe stay synchronized to agree on who has how many bitcoins?

How do we prevent people from reverting or manipulating Bitcoin transactions in the future?

This is where the Bitcoin blockchain comes into play.

The Bitcoin Blockchain

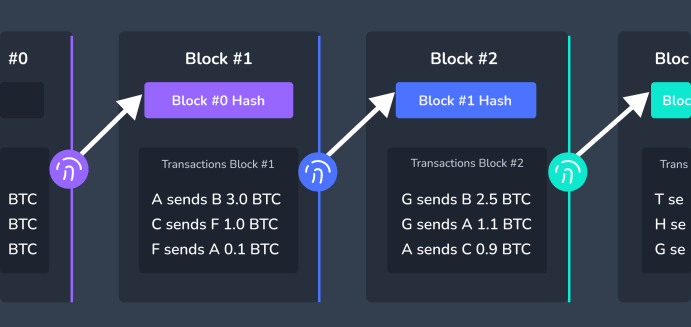

All transactions of sending and receiving bitcoins are stored in the Bitcoin blockchain, which is a continuously growing database that groups all transactions ever made on the Bitcoin network in the form of blocks.

The blockchain is stored and updated by all so-called nodes of the Bitcoin network, which are volunteers all around the world that run the Bitcoin software and actively verify and ensure that everything in the Bitcoin network runs by the rules.

What makes the blockchain so special in comparison to a normal database, is that every single entry in the blockchain, a so-called block, not only contains newly added Bitcoin transactions but also a unique link to its previous block.

Because every single block links to its previous block by storing the unique fingerprint of that block - the previous block hash -, a cryptographic seal is generated that prevents both these linked blocks from ever being altered again without immediately being noticed by the network.

Hence, because each block of the Bitcoin blockchain is chained together with its direct predecessor and successor, the blocks make up a chain of blocks - the "Blockchain" - which secures these blocks with all of their transactions from ever being manipulated.

For this reason, after a new block is added to the Bitcoin blockchain, it's so hard to ever alter or revert any of its transactions, that Bitcoin transactions can be considered permanent and non-reversible. This gives all owners of Bitcoin a high assurance of Bitcoin's correctness and the security of their funds.

Bitcoin Nodes

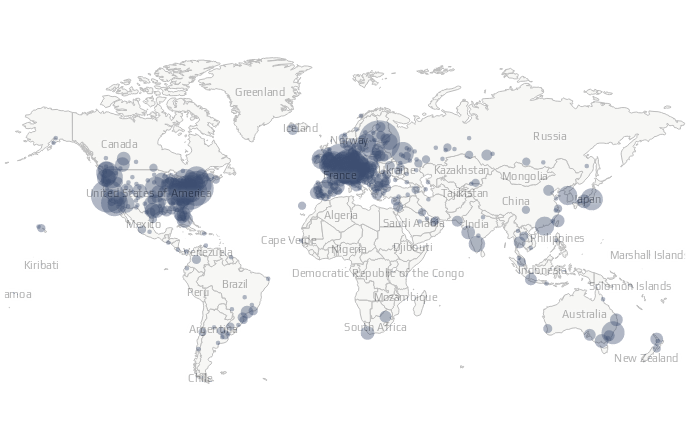

Bitcoin nodes are globally distributed computers run by volunteers that store the entire Bitcoin blockchain with every single recorded Bitcoin transaction and define and enforce the rules of the Bitcoin network.

Bitcoin nodes make up the global Bitcoin network by actively listening for new user-submitted transactions and keeping track of the up-to-date state of the Bitcoin blockchain: Without nodes, Bitcoin would officially not exist.

The global distribution of Bitcoin nodes is essential for Bitcoin's decentralization: Because Bitcoin nodes are located all around the world and are not concentrated in single areas of the globe, Bitcoin forms a practically unstoppable financial network.

Additionally, Bitcoin nodes play a crucial role in Bitcoin's security, as all nodes enforce the previously agreed-upon rules that define what is allowed in Bitcoin, and what is it.

Nodes are the gatekeepers of the Bitcoin network: They actively guard the Bitcoin network to protect it from fraudulent transactions.

In practical terms: If a user attempts to send another user more bitcoin than he owns, nodes will detect the fraud by checking their locally installed version of the blockchain and reject the transaction, as it violates the agreed-upon rules of Bitcoin. Such a transaction would never make it into any block of the blockchain.

You do not necessarily need your own Bitcoin node to send and receive bitcoin, but running your own Bitcoin node allows you to validate the blockchain, help Bitcoin be more decentralized, and empower the rules of Bitcoin that you support. Unlike Bitcoin mining, running your own Bitcoin node requires barely any energy and does not generate any bitcoin rewards.

Bitcoin Miners: Proof of Work

While Bitcoin nodes secure and maintain the already existing part of the blockchain, Bitcoin needs a mechanism to extend its blockchain by new blocks of transactions, to allow users to send and receive bitcoins -- that's where Bitcoin miners come into play.

Bitcoin miners are independent computers spread all around the world that are responsible for creating new blocks consisting of user transactions for the Bitcoin blockchain, in order to process those transactions.

Bitcoin miners group user-submitted transactions in blocks and solve hard computational work to add their blocks to the public Bitcoin blockchain, which grants them a reward in form of newly mined bitcoins. This process is called Bitcoin Mining.

Practically speaking: After a user broadcasts a Bitcoin transaction to the network, the transaction is added to the so-called mempool by the Bitcoin nodes, where it is in a pending state and waits to be included in a new block in order to be confirmed.

In order to process the pending transactions of users, Bitcoin miners pick up transactions from the mempool, verify their validity, and compose new blocks for the blockchain containing these selected transactions.

Why Bitcoin consumes so much power

Bitcoin's so-called Proof of Work consensus mechanism enforces a rule that every single block of transactions in the Bitcoin blockchain must have a large amount of electrical work associated with it.

Due to the required Proof of Work, for a Bitcoin miner to mine a new block, the digital fingerprint of the block - the block hash - has to start with a number of zeros specified by the network.

In an attempt to find a new block with a valid block hash that meets the Proof of Work criteria, a single common Bitcoin mining device calculates the hash value of up to 130.000.000.00,00 random different block variations per second 🤯, which is highly energy consuming.

The first Bitcoin miner to be lucky enough to find a Block that fulfills the current Proof of Work requirements broadcasts his block containing all of its new transactions to the Bitcoin nodes, which quickly verify it, and add it to the Bitcoin blockchain.

Finding a new valid block confirms all transactions that it included, which grants the miner a mining reward in the form of new bitcoins, as well as the transaction fees paid by users.

Bitcoin's Proof of Work mechanism forms an essential security feature of Bitcoin and is not a waste of energy: If Bitcoin mining would not require lots of energy, anyone could simply spam the Bitcoin network with millions of new blocks per second, which would make the Bitcoin network grow insanely big, and eventually cause a total collapse of Bitcoin.

Bitcoin Mining Difficulty

The number of zeros the block hash of a newly mined block has to start with depends on the current mining difficulty.

The more miners are active in the Bitcoin network, the more zeros the block hash has to start with, which makes it harder and more energy-expensive to mine.

By automatically adjusting the mining difficulty, the Bitcoin network ensures to only add a new block every ~10 minutes on average, which allows for constant growth and decentralization - More on that later.

Why Bitcoin is scarce

As previously mentioned, whenever a Bitcoin miner finds a valid block with a lot of computational power and luck, he broadcasts it to the network and gains a reward in the form of bitcoin.

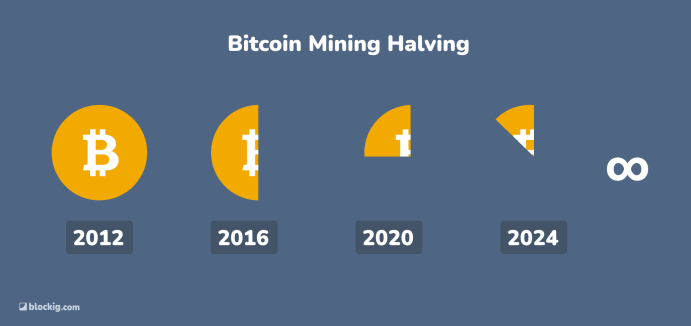

The reward for mining a new Bitcoin block gets decreased by 50% roughly every 4 years, which is called the Bitcoin Halving.

The Bitcoin halving happens automatically as it is one of the many rules defined in the software of all Bitcoin nodes in the network.

How many Bitcoins are there?

Due to the progressive Bitcoin Halving, there can never exist more than ~21 million bitcoins, which makes Bitcoin a deflationary cryptocurrency with fixed scarcity.

This means if someone owns 0.5 bitcoin now, the Bitcoin network in its current state guarantees that he will forever own 0.5/21.000.000 of all bitcoin to ever exist.

Because the issuance rate of bitcoin gets reduced by half every 4 years, owners of bitcoin are incentivized to hold their bitcoin for a long period of time, no matter the current price, instead of selling them for money which will, sooner or later, be inflated.

A consequence of the Bitcoin Halving is that at some point (approx. May 2140), there will be no more bitcoin rewards paid out to Bitcoin miners, at which point miners will only be rewarded with transaction fees paid by users.

Bitcoin Price Development

Bitcoin's price development is one of the most interesting aspects of the cryptocurrency's history which attracts many investors.

At the very start of Bitcoin, the cryptocurrency had no determinable value as it was not traded on any crypto exchanges but rather on public forums or chat groups for just a few cents per bitcoin.

Bitcoin's first viral price development milestone occurred on May 22, 2010, when a software developer called Laszlo Hanyecz bought two pizzas for 10,000 bitcoins. At that time, a bitcoin was worth less than a cent, making the pizzas cost him only about $25. However, in today's market, those same 10,000 bitcoins would be worth over 500 million US dollars.

Since then, Bitcoin has experienced several ups and downs, with its price reaching an all-time high of nearly $65,000 in April 2021, before dropping to around $30,000 shortly after, which shows how volatile Bitcoin's price can be.

A factor that has played a significant role in Bitcoin's price development is the halving of the cryptocurrency, which occurs once every ~4 years.

What drives the value of Bitcoin?

One of the main reasons for Bitcoin's rising price is its deflationary emission rate: Bitcoin has a fixed scarcity of 21 million bitcoins to ever exist, and every single Bitcoin halving reduces the emission of newly mined bitcoins by another 50% every four years.

This makes Bitcoin more and more scarce over time, as fewer new bitcoins get created that could be sold on the public market.

The event of every single Bitcoin Halving lowering the emission rate of Bitcoin by 50% every four years has so far always been followed by a supply shock, as fewer bitcoins are being sold at a remaining demand rate.

Due to the rules of supply and demand, a falling supply rate at a constant or rising demand rate causes Bitcoin's price to go up long term.

The price development of Bitcoin after every single halving shows a common pattern of rising and crashing Bitcoin prices, which is often referred to as the crypto cycle. Still, at the end of every crypto cycle, Bitcoin tends to be slightly higher valued than before, marking a long-term upward trend.

While this doesn't mean that Bitcoin will continue rising in price forever at the same relative rates, Bitcoin's halving makes the cryptocurrency extremely scarce and an interesting investment in a world of devaluing currencies and inflation.