Bitcoin Halving Countdown

Bitcoin Halving Explained

When a Bitcoin miner is lucky enough to find a new block, they are allowed to mine a predetermined amount of new bitcoin for themselves as a reward for their contribution to securing the network.

The Bitcoin Halving is an event that occurs roughly every four years, where the amount of bitcoins a miner can mine when creating a new block is cut in half (reduced by 50%).

Because mining is the only mechanism to produce new bitcoin, the Halving keeps reducing Bitcoin's emission rate, up to a point in the far future where no more bitcoin will be created. Hence, the Halving is responsible for a hard cap of 21 million bitcoin ever to exist, making Bitcoin scarce.

A common misconception is that the Bitcoin Halving halves the coins of Bitcoin owners. In reality, the Halving only reduces mining rewards – the bitcoin you own are untouched!

Because Bitcoin's economic success and price action heavily depend on the Halving, this event is a big deal in the cryptocurrency community, much like a New Year party with everyone eagerly counting down to the moment it happens.

Bitcoin Halving Schedule

As previously mentioned, the Bitcoin Halving event occurs approximately every four years, starting from the genesis block—the first block in the Bitcoin blockchain mined in January 2009.

When talking about the Bitcoin Halving schedule, we have to work with estimates, because the Halving takes place once every 210,000 blocks are mined. The exact duration it takes for these blocks to be mined is heavily influenced by randomness and the variable number of active miners in the network.

The next Bitcoin halving is estimated to be in April 2028, where miners will start receiving 1.5625 BTC instead of 3.125 BTC for mining new Bitcoin blocks.

| Halving | Mining Reward | Block Height | Date | Bitcoin Price |

|---|---|---|---|---|

| - | 50.00 ₿ | 0 | 03.01.2009 | 0$ |

| #1 | 25.00 ₿ | 210000 | 28.11.2012 | 56.5$ |

| #2 | 12.50 ₿ | 420000 | 09.07.2016 | 653.87$ |

| #3 | 6.25 ₿ | 630000 | 11.05.2020 | 8,752.62$ |

| #4 | 3.13 ₿ | 840000 | 20.04.2024 | - |

| #5 | 1.56 ₿ | 1050000 | April 2028 | - |

| #6 | 0.78 ₿ | 1260000 | April 2032 | - |

| #7 | 0.39 ₿ | 1470000 | April 2036 | - |

| #8 | 0.2 ₿ | 1680000 | April 2040 | - |

| #9 | 0.098 ₿ | 1890000 | April 2044 | - |

| #10 | 0.049 ₿ | 2100000 | March 2048 | - |

| #11 | 0.024 ₿ | 2310000 | March 2052 | - |

| #12 | 0.012 ₿ | 2520000 | March 2056 | - |

| #13 | 0.0061 ₿ | 2730000 | March 2060 | - |

| #14 | 0.0031 ₿ | 2940000 | March 2064 | - |

| #15 | 0.0015 ₿ | 3150000 | March 2068 | - |

| #16 | 0.00076 ₿ | 3360000 | March 2072 | - |

| #17 | 0.00038 ₿ | 3570000 | March 2076 | - |

| #18 | 0.00019 ₿ | 3780000 | March 2080 | - |

| #19 | 0.000095 ₿ | 3990000 | March 2084 | - |

| #20 | 0.000048 ₿ | 4200000 | March 2088 | - |

The first Bitcoin Halving occurred at the block height of 210,000, in November 2012, when the mining rewards were halved from 50 BTC to 25 BTC.

The second halving occurred in 2016, reducing it further to 12.5 bitcoin per block. Subsequently, in 2020, it halved again to 6.25 bitcoin per block.

The Bitcoin mining rewards will keep being halved every four years, forever, until they start approaching 0 BTC per block in the year 2068 and beyond.

How does the Bitcoin Halving occur?

The Bitcoin Halving process is programmed into Bitcoin's core software that runs on all Bitcoin Nodes around the globe. The halving of mining rewards occurs automatically once the target block for the Halving is reached.

For example, the target block for the next Bitcoin Halving in 2028 is the block 1,050,000. Once this block height is reached, all Bitcoin miners will automatically start receiving half the amount of bitcoin from the so-called Coinbase transaction as a reward compared to the blocks before.

If a miner ignored the Halving event and tried to mine a higher amount of bitcoin for himself, all Bitcoin nodes around the globe would reject such a block, and deem it invalid. This forces all miners and users of the Bitcoin network to comply with the Halving.

Why does Bitcoin undergo the Halving?

The Bitcoin Halving serves a crucial economic purpose: it makes Bitcoin mining like gold mining, where the emission of new coins is systematically reduced over time. While the supply of gold on Earth is inherently limited, the Halving event for Bitcoin simulates this scarcity within the digital realm. This mechanism creates scarcity and ensures the long-term value of Bitcoin.

That's why Bitcoin is often referred to as digital Gold.

The Bitcoin Halving is not a restriction or punishment for miners; it's a rule everyone in the Bitcoin network agrees on, as reducing emissions ensures economic prosperity for Bitcoin as a store of value.

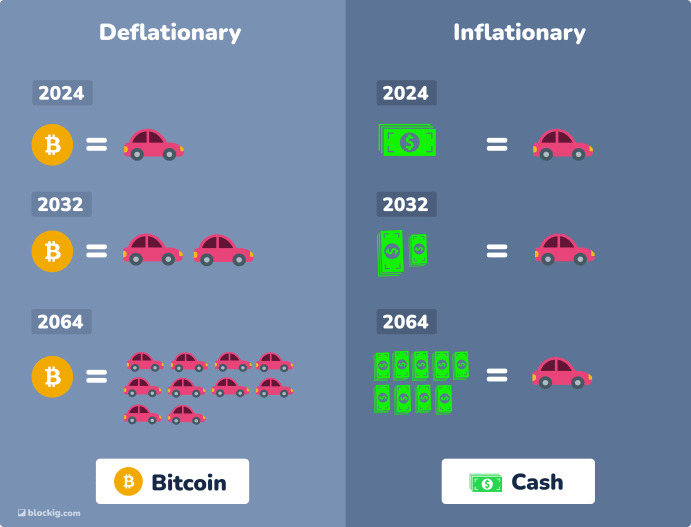

This deliberate reduction in supply counteracts the effects of inflation, a phenomenon that plagues traditional fiat currencies and erodes their value over time. By limiting the issuance of new bitcoin, the Halving ensures that the total supply of the cryptocurrency will never exceed 21 million bitcoin, making it a "hard money" that people can save in.

Without the Halving, Bitcoin would risk facing the same fate as fiat money, continually inflating and devaluing over time. In such a scenario, individuals would be incentivized to spend their bitcoin quickly, driven by the fear of diminishing purchasing power.

With the deflationary nature instilled by the Halving, Bitcoin encourages savers to be careful with their consumption, fostering a culture of long-term wealth accumulation and financial responsibility. In this way, the Bitcoin Halving not only increases Bitcoin's Price in the long run but also aligns with its ethos of decentralization and economic empowerment.

Bitcoin Halving's Impact on Price

The Bitcoin Halving has a very positive impact on the cryptocurrency's price, often resulting in significant price spikes following each Halving event. This phenomenon is primarily driven by the reduction in the supply of new bitcoin entering the market, as miners suddenly only have half the coins to sell to finance their operations.

With fewer coins available for sale by miners, a supply shock occurs, often leading to increased demand and subsequently higher prices after every Bitcoin Halving. This dynamic is reinforced by many miners holding onto their coins in anticipation of rising prices, creating a self-fulfilling prophecy of an ever-rising Bitcoin price.

With a predictable supply shock occurring every four years as part of the Halving, Bitcoin leads cryptocurrency cycles, with peak bull markets occurring roughly every four years. Many famous economic models on Bitcoin, like the Stock-to-Flow (S2F) model, leverage the reduced supply of new bitcoin resulting from the Halving to predict future price levels pretty successfully.

This makes the Bitcoin Halving not only an essential event for Bitcoin, but also for the crypto markets as a whole.

However, it's important to recognize that the impact of the Halving on Bitcoin's price may diminish over time as market participants anticipate and try to price in the halved emission rate many years ahead. Hence, while the Halving still makes Bitcoin deflationary, as more capital flows into Bitcoin, we should see less and less volatility over time. This aligns with Bitcoin's long-term goal of becoming stable money without many ups and downs.

Counting down towards the Bitcoin Halving

Everyone in the cryptocurrency community eagerly counts down towards the Bitcoin halving event, a pivotal moment for the entire crypto market.

Therefore, we created a Bitcoin Halving Countdown with the latest estimates on when the next Bitcoin halving is about to happen top of this page. The estimates of our Bitcoin Halving Countdown are based on the current block height, mining speed, and upcoming difficulty adjustments.

Since every Halving is scheduled for a specific block height and Bitcoin holds an average block time of 10 minutes, we can roughly estimate the remaining minutes until the next Bitcoin Halving by multiplying the remaining blocks by 10.

But why all the excitement?

The Bitcoin halving isn't just a technical adjustment; as previously mentioned, it's a game-changer that impacts the entire crypto market. Therefore, traders, investors, and enthusiasts worldwide are closely following the Bitcoin Halving countdown, speculating on how it might affect Bitcoin's price and the broader cryptocurrency market.

Given that this essential event only occurs once every four years, counting towards the next Bitcoin Halving is comparable to counting towards the start of a new year.

Awaiting the Bitcoin Halving Countdown represents a collective anticipation that has formed throughout the past few years in the Bitcoin community, which can be seen all across social media once the mining countdown starts running low.

With our Bitcoin Halving Countdown, you can take part in this excitement, and track an advanced estimated date of the upcoming Halving at any point in time.