| Coinbase | eToro | |

|---|---|---|

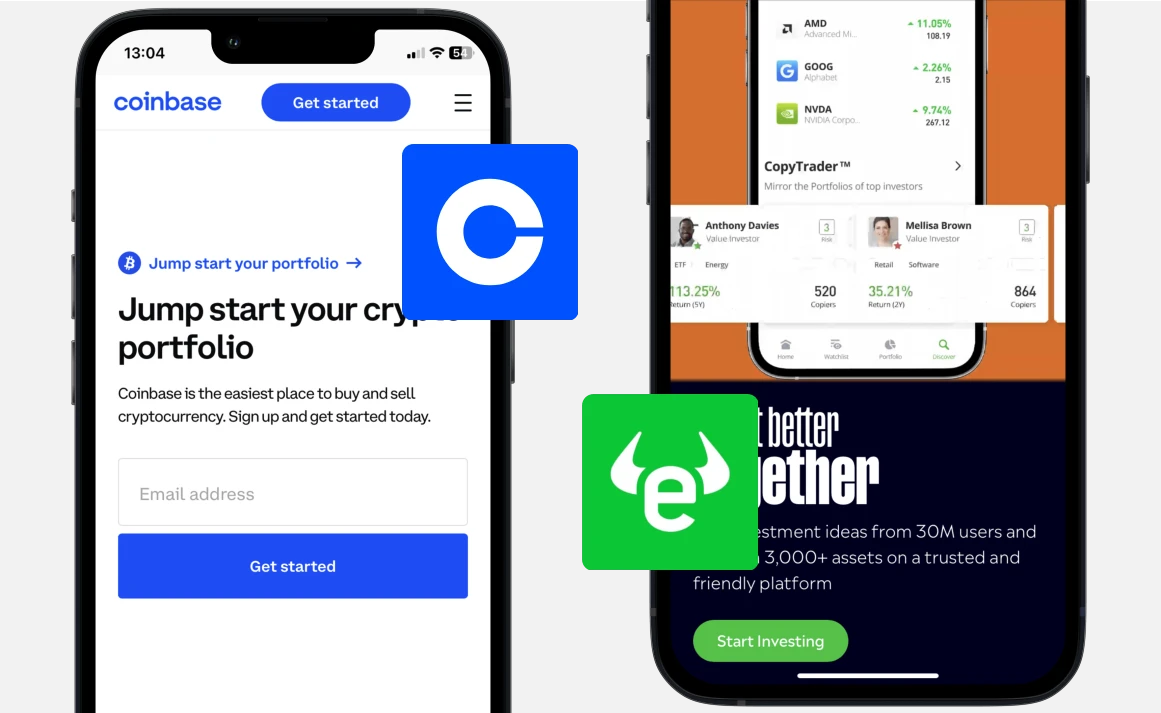

| Introduction | Coinbase Coinbase is an international crypto exchange listed on the US stock market, that offers trading of hundreds of crypto assets since 2012. The USA-based crypto exchange offers both a simple trading mode for beginners, as well as an advanced trading view for experienced traders. Hence Coinbase is suitable for any type of crypto investor. Coinbase is regulated worldwide and is the first-ever crypto exchange to be licensed by the German BaFin. | eToro eToro is a popular multi-asset broker founded in 2007 that offers to trade cryptocurrencies, stocks, ETFs, and more. eToro is known for providing many deposit methods and a simple trading interface with unique features, such as Copy Trading. Furthermore, eToro has multiple international branches and is regulated in many regions worldwide, making it a secure and reliable trading platform. |

| Availibility | ||

| Pros |

|

|

| Cons |

|

|

| Coinbase | eToro | |

|---|---|---|

| Tradable Assets | Cryptocurrencies | CFDs, Cryptocurrencies, Crypto Indices, Derivates, ETFs, Forex, Precious Metals, Stocks |

| Cryptocurrencies | 230+ | 75+ |

| Stocks | - | 3624+ |

| ETFs | - | 331+ |

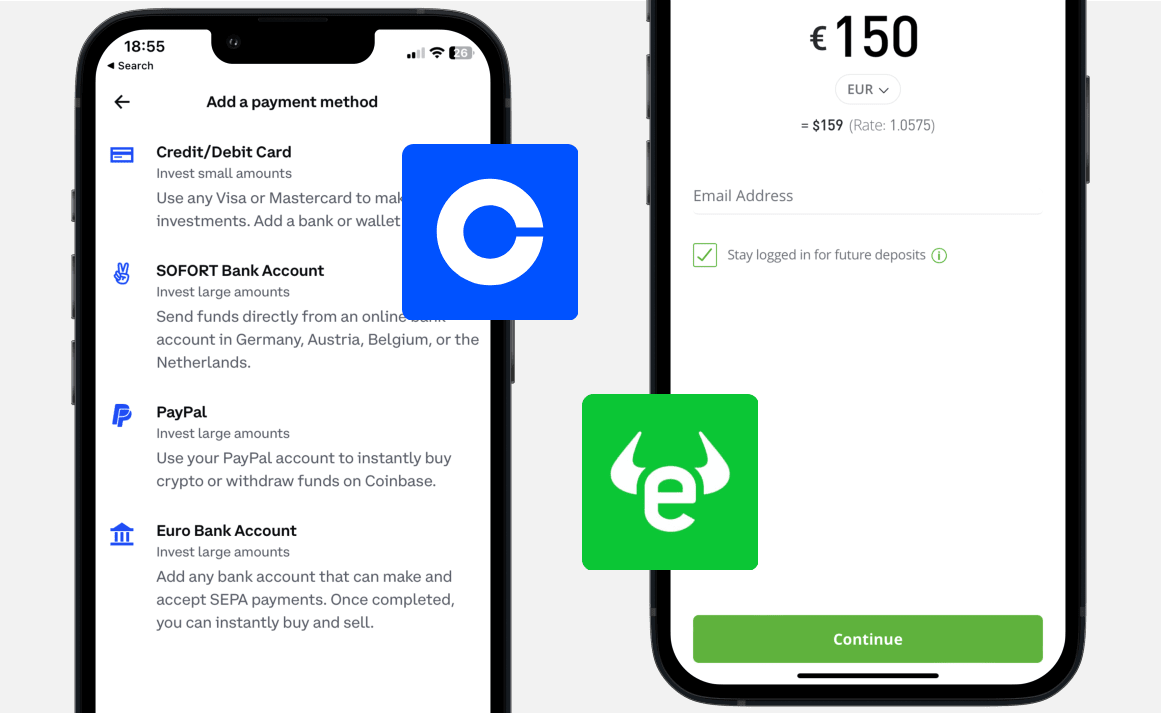

| Payment Methods | ||

| Min. Deposit | 2$ | 50$ |

| Verification | ID, Video | ID |

| Languages | 🇩🇪 German | 🇪🇸 Spanish |

| Headquarters | 🇺🇸 United States | 🇮🇱 Israel |

| Regulations | 🇦🇺 AUSTRAC, 🇩🇪 BaFin, 🇮🇪 CBI, 🇳🇱 DNB, 🇬🇧 FCA, 🇺🇸 FinCEN | 🇦🇺 ASIC, 🇨🇾 CySEC, 🇬🇧 FCA, 🇺🇸 FinCEN |

| Founded In | 2012 | 2007 |

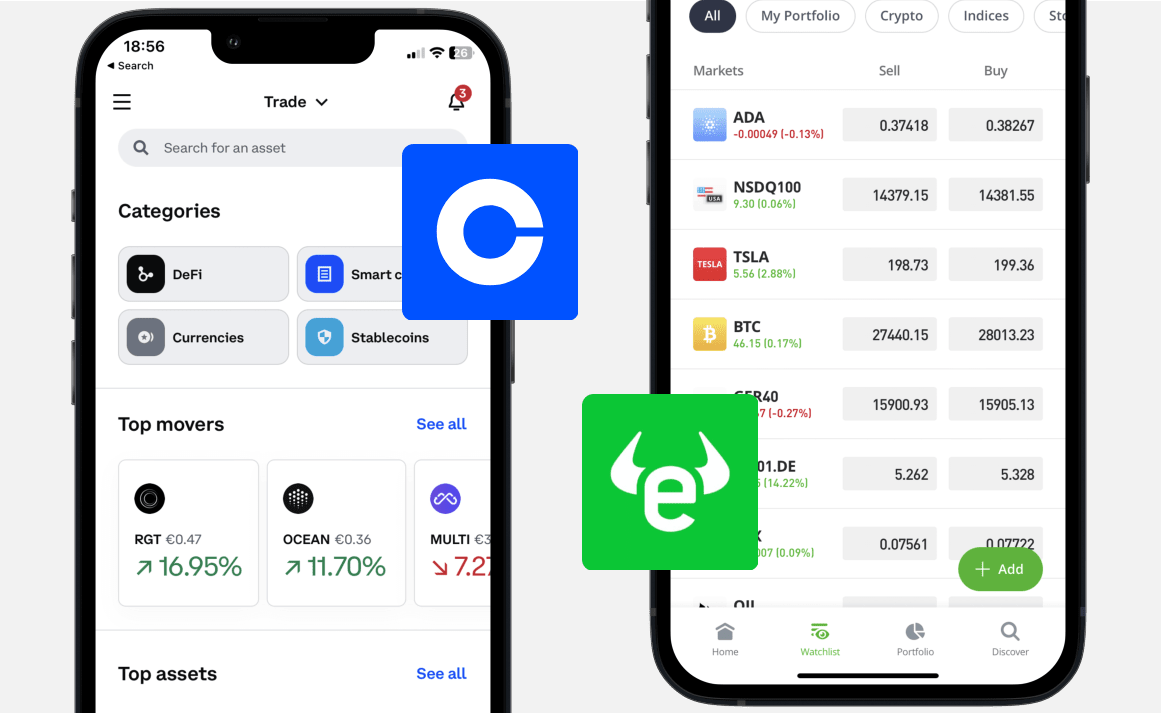

Coinbase vs eToroShowcase

| Coinbase | eToro | |

|---|---|---|

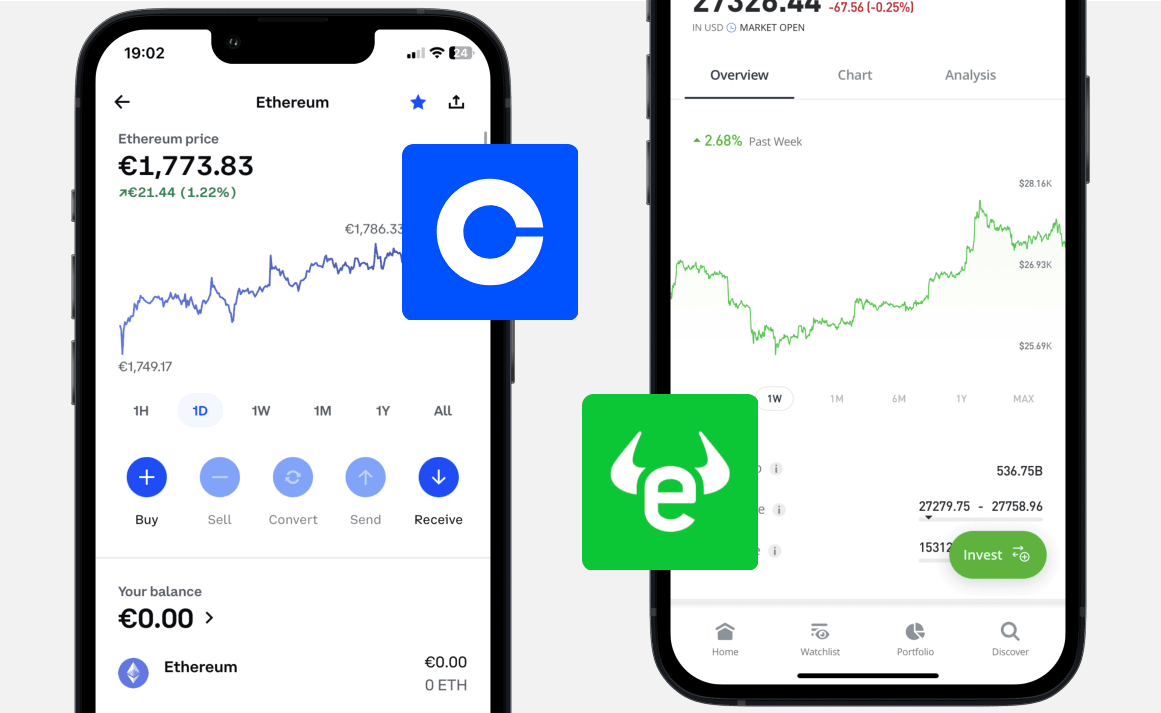

| Fee Structure | Coinbase Coinbase has different fees for different trading modes. When trading in the easy swapping interface, users encounter a high spread of 0-3%, depending on the cryptocurrency traded. On the other hand, users of Coinbase Advanced Trade benefit from very tight spreads and low trading fees of 0-0.6% that get lower the more you trade. Coinbase's advanced trading offers the same, large selection of cryptocurrency markets. | eToro Trading fees on eToro vary based on the traded assets. While trading cryptocurrencies on eToro comes with a moderate fee of 1%, trading stocks and ETFs on eToro comes with no trading fees at all. |

| Standard Crypto Fee | 0-3% | 1% |

| Advanced Crypto Fee | 0-0.6% | - |

| Average Crypto Fee | 0.90% | 1% |

| Coinbase | eToro | |

|---|---|---|

| < 10,000$ | 0.4-0.6% | 1% |

| < 50,000$ | 0.25-0.4% | 1% |

| < 100,000$ | 0.15-0.25% | 1% |

| Coinbase | eToro | |

|---|---|---|

| Tradable Coins |

|

|

Yes | Yes | |

Yes | Yes | |

Yes | Yes | |

Yes | Yes | |

Yes | Yes | |

Yes | Yes |

| Coinbase | eToro | |

|---|---|---|

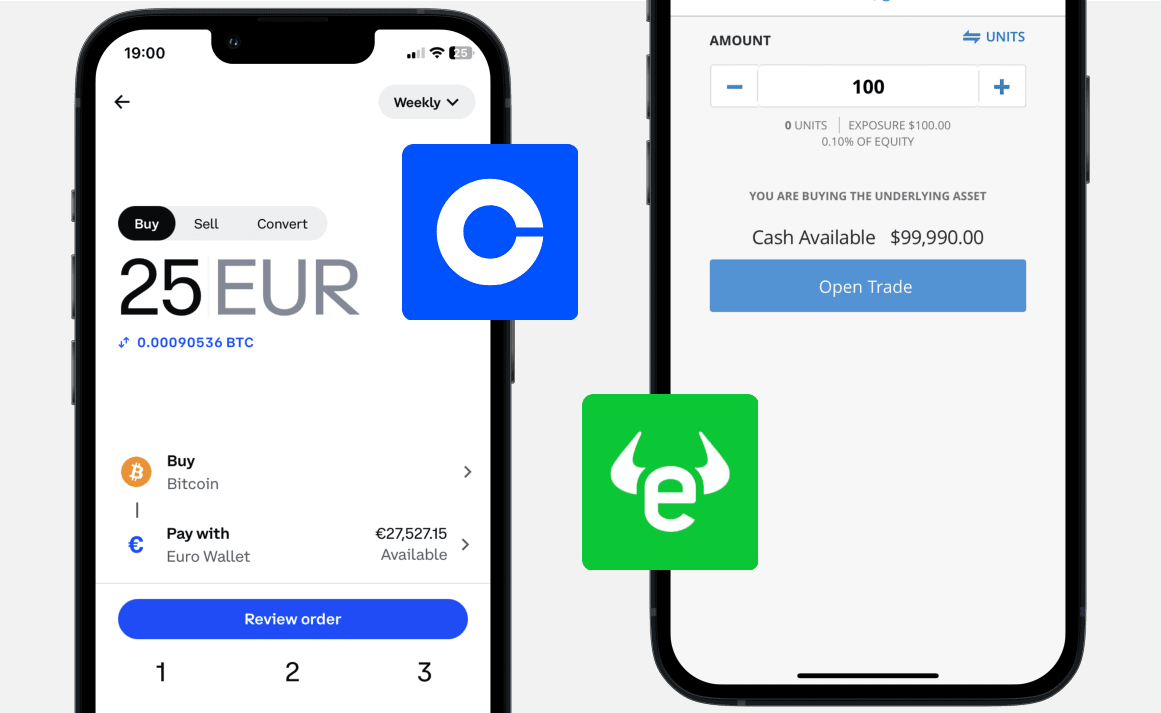

| Mobile App | Android,iOS | Android,iOS |

| Web Version | Yes | Yes |

| Easy Trading | Yes | Yes |

| Pro Trading | No | |

| Demo Account | No | |

| Signup Bonus | No | No |

| Recurring Buys | Yes | No |

| Real Crypto | Yes | Yes |

| Withdrawable Crypto | Yes | Yes |

| Crypto Staking | Yes | Yes |

| Crypto Lending | No | No |

Why Coinbase over eToro? | |

|---|---|

|

|

| Coinbase | eToro | |

|---|---|---|

| Registration Speed | ||

| Simplicity | ||

| Coins | ||

| Features | ||

| Fees | ||

| Opinion |  Coinbase 90% Very Good /2025 Coinbase provides a flawless user experience and easy access to crypto trading with almost instant account registrations. Because Coinbase is listed on the US stock market, we believe this exchange is one of the most stable international crypto exchanges one can choose from today. We recommend Coinbase to crypto investors who value regulatory safety and transparency more than low trading fees: We find the trading fees on Coinbase a bit too high, especially in the default trading mode. |  eToro 92% Great /2025 With various tradable assets and relatively low trading fees, we see eToro as the best multi-asset broker for a quick and easy start to investing in all sorts of assets. We particularly appreciate eToro for numerous deposit methods including PayPal, 0% fees for trading stocks and ETFs, and copy trading with a very large community. However, eToro could improve its rather high fees for withdrawals of crypto and cash. |